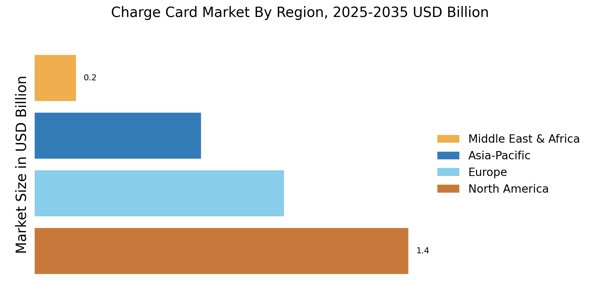

North America : Market Leader in Charge Cards

North America remains the largest market for charge cards, holding approximately 45% of the global market share. The growth is driven by increasing consumer spending, a shift towards cashless transactions, and robust regulatory support for digital payments. The U.S. is the primary contributor, followed by Canada, which is experiencing a surge in demand for flexible payment options. Regulatory frameworks are evolving to support innovation in financial services, enhancing consumer trust and adoption. The competitive landscape is dominated by key players such as American Express, Visa, and Mastercard, which have established strong brand loyalty. The presence of these companies fosters innovation and competition, leading to enhanced product offerings. Additionally, the rise of fintech companies is reshaping the market, providing consumers with more choices and tailored solutions. The focus on rewards and benefits continues to attract consumers, further solidifying North America's position in the charge card market.

Europe : Emerging Market Dynamics

Europe is witnessing a significant transformation in the charge card market, with a market share of approximately 30%. The growth is fueled by increasing digitalization, a rise in e-commerce, and favorable regulatory environments that promote financial inclusion. Countries like the UK and Germany are leading this trend, with a growing number of consumers opting for charge cards due to their benefits and flexibility. Regulatory initiatives aimed at enhancing consumer protection are also contributing to market growth. The competitive landscape features major players such as Visa, Mastercard, and local banks that are adapting to changing consumer preferences. The presence of innovative fintech solutions is reshaping the market, offering consumers more personalized options. Additionally, the European Central Bank's initiatives to promote digital payments are expected to further boost the charge card market, making it a key area of focus for financial institutions and consumers alike.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific region is emerging as a powerhouse in the charge card market, holding approximately 20% of the global market share. The growth is driven by increasing urbanization, a burgeoning middle class, and a shift towards digital payment solutions. Countries like China and India are at the forefront, with rising disposable incomes and a growing appetite for credit products. Regulatory support for digital finance is also a significant catalyst for market expansion, encouraging innovation and competition. The competitive landscape is characterized by the presence of local and international players, including UnionPay and JCB, which are gaining traction among consumers. The rise of mobile payment platforms and e-commerce is further driving the adoption of charge cards. As consumers seek more flexible payment options, the market is expected to continue its upward trajectory, with a focus on enhancing customer experience and rewards programs.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the charge card market, currently holding about 5% of the global market share. The growth is primarily driven by increasing financial literacy, a young population, and a shift towards cashless economies. Countries like South Africa and the UAE are leading the charge, with government initiatives aimed at promoting digital payments and financial inclusion. Regulatory frameworks are evolving to support the growth of the charge card market, creating a conducive environment for innovation. The competitive landscape is still developing, with local banks and international players beginning to establish their presence. Key players are focusing on offering tailored products to meet the unique needs of consumers in this region. As the market matures, the emphasis on customer service and rewards programs is expected to play a crucial role in attracting consumers and driving growth in the charge card sector.