Regulatory Innovations

Regulatory innovations are shaping the Challenger Bank Market, as governments and regulatory bodies adapt to the evolving financial landscape. In recent years, several jurisdictions have introduced frameworks that facilitate the entry of challenger banks into the market, promoting competition and consumer choice. For instance, regulatory sandboxes allow new entrants to test their services in a controlled environment, fostering innovation while ensuring consumer protection. As of October 2025, the number of countries implementing such initiatives has increased, indicating a growing recognition of the importance of fostering a dynamic banking ecosystem. This regulatory support not only encourages the establishment of new challenger banks but also enhances the overall credibility of the industry. Consequently, the Challenger Bank Market is likely to benefit from a more favorable regulatory environment that promotes innovation and competition.

Enhanced Financial Inclusion

Enhanced financial inclusion is a pivotal driver in the Challenger Bank Market, as these institutions aim to serve underbanked and unbanked populations. By leveraging technology, challenger banks can offer accessible financial services to individuals who may have been excluded from traditional banking systems. As of October 2025, it is estimated that over 1.7 billion adults worldwide remain unbanked, presenting a significant opportunity for challenger banks to fill this gap. By providing low-cost accounts and simplified onboarding processes, these banks can attract a diverse customer base. This focus on financial inclusion not only benefits consumers but also contributes to broader economic growth, as increased access to banking services can stimulate local economies. The Challenger Bank Market is thus likely to see continued expansion as it addresses the needs of underserved communities.

Competitive Pricing Strategies

Competitive pricing strategies are emerging as a critical driver within the Challenger Bank Market. Challenger banks often offer lower fees and attractive interest rates compared to traditional banks, appealing to cost-conscious consumers. Recent data suggests that challenger banks can reduce operational costs by up to 30% through digital-only models, allowing them to pass savings onto customers. This pricing advantage not only attracts new clients but also encourages existing customers to switch from traditional banks. As the market becomes increasingly saturated, challenger banks are likely to continue innovating their pricing structures to maintain competitiveness. This dynamic could lead to a more favorable environment for consumers, fostering a culture of transparency and value in the financial services sector.

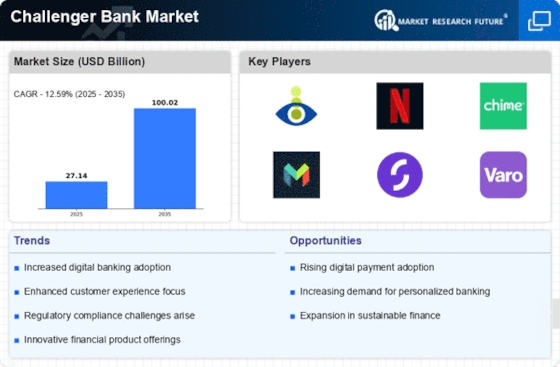

Rise of Digital Banking Adoption

The Challenger Bank Market is experiencing a notable rise in digital banking adoption, driven by consumers' increasing preference for online financial services. As of October 2025, approximately 70% of banking customers utilize digital platforms for their transactions, indicating a shift from traditional banking methods. This trend is further supported by the proliferation of smartphones and internet access, which facilitates seamless banking experiences. Challenger banks, with their focus on user-friendly interfaces and innovative features, are well-positioned to capture this growing market segment. The convenience of managing finances through mobile applications appeals to tech-savvy consumers, thereby enhancing customer engagement and loyalty. Consequently, the Challenger Bank Market is likely to witness sustained growth as more individuals opt for digital banking solutions over conventional banking options.

Technological Advancements in Banking

Technological advancements in banking are a driving force within the Challenger Bank Market, as these institutions leverage cutting-edge technologies to enhance their offerings. The integration of artificial intelligence, machine learning, and blockchain technology is transforming how banks operate and interact with customers. As of October 2025, it is estimated that over 60% of challenger banks utilize AI-driven solutions for customer service and fraud detection, improving efficiency and security. These technologies enable challenger banks to provide personalized services, streamline operations, and reduce costs. Furthermore, the ongoing development of fintech solutions is likely to spur further innovation within the industry. As a result, the Challenger Bank Market is poised for continued growth, as technological advancements create new opportunities for differentiation and customer engagement.