Growing Geriatric Population

The increasing geriatric population is a significant factor influencing the Central Venous Catheter Market. As individuals age, they often experience multiple health issues that require complex medical interventions, including the need for central venous access. Data indicates that the population aged 65 and older is expected to double by 2050, leading to a higher demand for healthcare services, including the use of central venous catheters. This demographic shift necessitates the development of specialized catheters that cater to the unique needs of elderly patients, such as ease of insertion and reduced risk of complications. Consequently, the Central Venous Catheter Market is poised for growth as healthcare systems adapt to accommodate the needs of an aging population, ensuring that effective vascular access solutions are readily available.

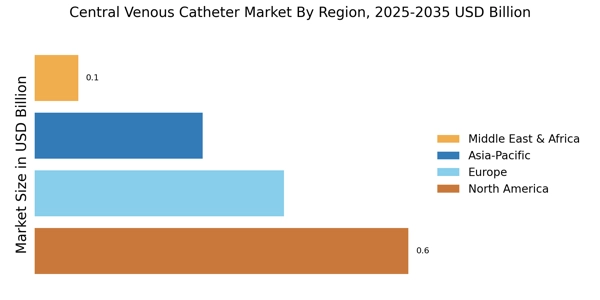

Rising Healthcare Expenditure

An increase in healthcare expenditure across various regions is driving the Central Venous Catheter Market. As governments and private sectors invest more in healthcare infrastructure, the availability of advanced medical devices, including central venous catheters, is improving. Recent statistics reveal that healthcare spending is projected to grow at a rate of 5% annually, reflecting a commitment to enhancing patient care and treatment options. This financial investment facilitates the procurement of high-quality medical devices, thereby expanding the market for central venous catheters. Furthermore, as healthcare systems prioritize the adoption of innovative technologies, the Central Venous Catheter Market is likely to benefit from increased funding and resources dedicated to improving vascular access solutions.

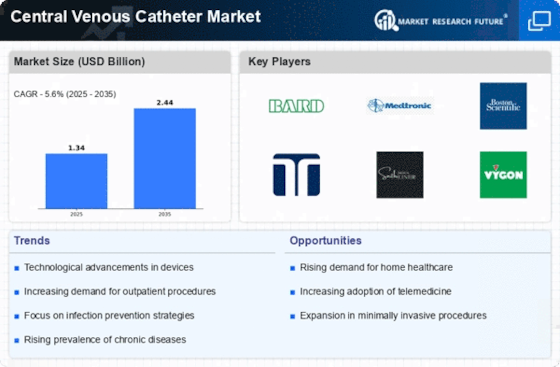

Advancements in Catheter Technology

Technological innovations in catheter design and materials are transforming the Central Venous Catheter Market. Recent advancements include the development of antimicrobial coatings and biocompatible materials that reduce the risk of infections and improve patient outcomes. The introduction of smart catheters equipped with sensors for real-time monitoring is also gaining traction. These innovations not only enhance the safety and efficacy of catheter use but also align with the growing emphasis on patient-centered care. Market data indicates that the segment of technologically advanced catheters is expected to witness a compound annual growth rate (CAGR) of over 8% in the coming years. This trend suggests that as technology continues to evolve, the Central Venous Catheter Market will likely expand, driven by the demand for safer and more effective vascular access solutions.

Increasing Incidence of Chronic Diseases

The rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver for the Central Venous Catheter Market. These conditions often necessitate long-term intravenous therapy, leading to an increased demand for central venous catheters. According to recent data, the incidence of chronic diseases is projected to rise significantly, with estimates suggesting that by 2025, nearly 60% of the population may be affected by at least one chronic condition. This trend underscores the critical role of central venous catheters in managing complex treatment regimens, thereby propelling market growth. As healthcare providers seek effective solutions for patient management, the Central Venous Catheter Market is likely to experience sustained demand, driven by the need for reliable and efficient vascular access.

Emphasis on Patient Safety and Quality Care

The growing emphasis on patient safety and quality care is a crucial driver for the Central Venous Catheter Market. Healthcare providers are increasingly focused on minimizing complications associated with catheter use, such as infections and thrombosis. Regulatory bodies are implementing stringent guidelines to ensure the safety and efficacy of medical devices, including central venous catheters. This regulatory focus is prompting manufacturers to innovate and enhance their product offerings, leading to the development of safer and more effective catheters. Market analysis suggests that the demand for high-quality, safety-compliant catheters is on the rise, as healthcare facilities strive to improve patient outcomes. Consequently, the Central Venous Catheter Market is likely to expand as stakeholders prioritize safety and quality in vascular access solutions.