Rising Geriatric Population

The increasing geriatric population in India is a significant driver for the central venous-catheter market. As the elderly population grows, so does the prevalence of age-related health issues that often require long-term medical care. Data suggests that by 2030, the number of individuals aged 60 and above in India will exceed 300 million, creating a substantial demand for effective healthcare solutions. Central venous catheters are essential for managing chronic conditions in this demographic, facilitating treatments such as chemotherapy and long-term medication administration. Consequently, healthcare providers are likely to invest more in these catheters to cater to the needs of the aging population, thereby propelling market growth.

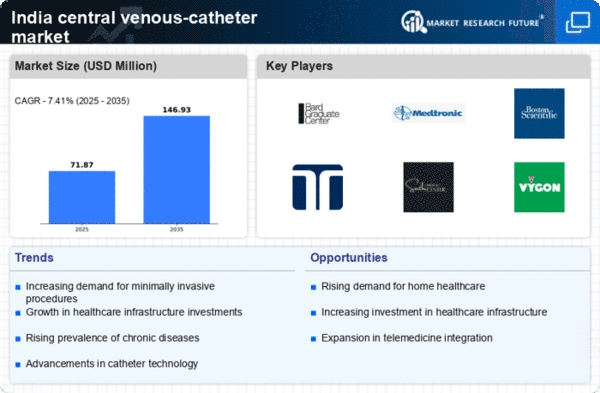

Expansion of Healthcare Infrastructure

India's healthcare infrastructure is undergoing substantial expansion, which is likely to bolster the central venous-catheter market. The government has been investing heavily in healthcare facilities, aiming to improve access to quality medical services across urban and rural areas. Recent reports indicate that healthcare expenditure in India is projected to reach $370 billion by 2025, reflecting a commitment to enhancing medical services. This expansion includes the establishment of new hospitals and clinics, which are increasingly equipped with advanced medical technologies, including central venous catheters. As more healthcare facilities become operational, the demand for these catheters is expected to rise, driven by the need for efficient patient management and treatment protocols.

Increasing Prevalence of Lifestyle Diseases

The rising incidence of lifestyle-related diseases in India, such as diabetes and hypertension, is driving the demand for the central venous-catheter market. As these conditions often require long-term treatment and monitoring, healthcare providers are increasingly utilizing central venous catheters for effective management. According to recent data, approximately 30% of the Indian population is affected by lifestyle diseases, necessitating advanced medical interventions. This trend indicates a growing need for reliable vascular access solutions, which central venous catheters provide. The healthcare sector is adapting to these challenges by investing in better catheter technologies, thereby enhancing patient care and outcomes. Consequently, the central venous-catheter market is expected to expand significantly as healthcare facilities strive to meet the needs of this patient demographic.

Government Initiatives for Healthcare Improvement

The Indian government is actively implementing initiatives aimed at improving healthcare access and quality, which is likely to impact the central venous-catheter market positively. Programs such as Ayushman Bharat are designed to provide affordable healthcare services to millions of citizens, thereby increasing the demand for various medical devices, including central venous catheters. With a focus on enhancing healthcare delivery systems, the government is encouraging the adoption of advanced medical technologies in hospitals and clinics. This push for modernization is expected to create a favorable environment for the central venous-catheter market, as healthcare facilities seek to comply with new standards and improve patient care.

Growing Awareness of Advanced Medical Technologies

There is a notable increase in awareness regarding advanced medical technologies among healthcare professionals and patients in India. This growing awareness is positively influencing the central venous-catheter market, as practitioners recognize the benefits of using these devices for various medical procedures. Educational initiatives and training programs are being implemented to familiarize healthcare providers with the latest catheter technologies, which can enhance patient outcomes. Furthermore, the market is witnessing a shift towards the adoption of innovative catheter designs that minimize complications and improve safety. As a result, the central venous-catheter market is likely to experience growth as healthcare professionals become more adept at utilizing these technologies in clinical settings.