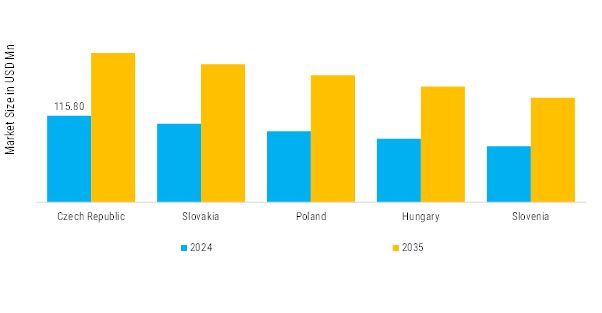

Slovakia: Automotive Manufacturing Hub

Slovakia is a key market within Central Europe for automotive steel tubes, driven by its strong vehicle production ecosystem and the presence of major global OEMs. Often referred to as one of the world’s highest per-capita car producers, Slovakia hosts manufacturing operations of Volkswagen, Kia, Stellantis, and Jaguar Land Rover, all of which create consistent demand for high-quality steel tubing used in chassis, suspension, exhaust, powertrain, and BIW (Body in White) structures. The country’s position within the EU ensures alignment with stringent regulatory frameworks related to emissions, safety, and material standards, further increasing the need for advanced steel tube solutions. A well-developed supplier base, strong logistics connectivity, and increasing investments in EV production capacity support Slovakia’s competitive landscape. As the local automotive sector accelerates toward electrification, the demand for precision-engineered tubes—especially for battery housing, thermal management, and lightweight structural components—is expected to grow, reinforcing Slovakia’s role as a strategic automotive steel tube market.

Poland: Expanding Automotive & Component Manufacturing Base

Poland represents one of the fastest-expanding markets for automotive steel tubes in Central Europe, supported by its rapidly developing automotive components sector, strong labour capacity, and growing investments from both European and Asian OEMs. The country produces a wide range of vehicle systems—drivetrains, exhaust components, seating frames, and fluid transport modules—driving robust demand for welded, seamless, hot-rolled, and cold-drawn steel tubes. Poland’s competitive advantage is enhanced by its extensive supplier network, favourable manufacturing costs, and increasing integration into regional EV supply chains. The market is further shaped by EU regulations emphasising lightweighting, safety, and the reduction of emissions, prompting manufacturers to adopt high-strength and corrosion-resistant steel tubing. With rising foreign direct investments, expansion of Tier-1 suppliers, and government support for electromobility, Poland is positioned as a rapidly advancing market for automotive steel tube applications.

Hungary: Growing EV Production & High-Precision Component Demand

Hungary is becoming a significant automotive steel tube market due to its strong pipeline of foreign automotive investments, particularly in electric vehicle production and high-precision components. The presence of OEMs such as Audi, Mercedes-Benz, Suzuki, and BMW—along with numerous Tier-1 suppliers—creates steady demand for steel tubes used in exhaust systems, chassis frames, crash structures, BIW components, and high-performance fluid handling systems. Hungary’s strategic shift toward electromagnetic mobility, supported by government incentives and large-scale battery manufacturing projects, is accelerating growth in demand for advanced seamless and cold-drawn tubes. These are used in battery cooling circuits, thermal modules, structural protection frames, and EV-specific load-bearing components. The competitive landscape is characterised by increasing technical sophistication, supply chain modernisation, and a growing emphasis on material efficiency, positioning Hungary as a fast-developing market for automotive steel tube solutions.

Slovenia: Niche Component Manufacturing & Precision Engineering

Slovenia, while smaller compared to other Central European peers, plays an important niche role in the automotive steel tube market due to its strong precision engineering sector and high-quality component manufacturing capabilities. The country supports production of specialized automotive systems, including exhaust modules, seat structures, safety reinforcements, and hydraulic assemblies—each requiring reliable and corrosion-resistant steel tubing. Slovenia benefits from its skilled engineering workforce, EU regulatory alignment, and strong export orientation, which helps local manufacturers integrate into broader European supply chains. As OEMs adopt lightweighting strategies and demand higher-precision tubing for powertrain, BIW, and fluid systems, Slovenian suppliers are increasingly focusing on cold-drawn, hydroformed, and high-strength tube solutions. Although the market is smaller in size, Slovenia’s emphasis on quality, innovation, and specialized component production positions it as a steadily growing contributor to the regional automotive steel tube landscape.