Rising Demand for CBD Products

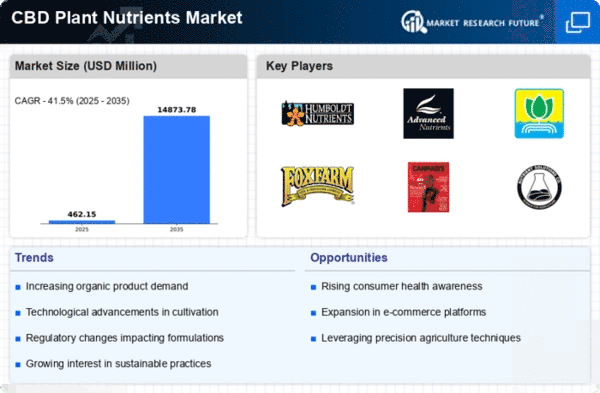

The Global CBD Plant Nutrients Market Industry experiences a surge in demand for CBD products, driven by increasing consumer awareness regarding the health benefits of CBD. As of 2024, the market is valued at 0.33 USD Billion, reflecting a growing acceptance of CBD in various sectors, including wellness and beauty. This trend is likely to continue as more consumers seek natural alternatives for health and wellness, thereby propelling the demand for high-quality CBD plant nutrients. The anticipated growth in the market indicates a robust trajectory, with projections suggesting that by 2035, the market could reach 14.9 USD Billion.

Expansion of CBD Market Applications

The expansion of CBD applications across various industries contributes to the growth of the Global CBD Plant Nutrients Market Industry. CBD is increasingly utilized in sectors such as food and beverage, cosmetics, and pharmaceuticals, broadening its market reach. This diversification creates a heightened demand for specialized plant nutrients tailored to support the unique requirements of CBD cultivation. As the market evolves, producers are likely to invest in research and development to create innovative nutrient solutions, thereby fostering growth. The projected increase in market value to 14.9 USD Billion by 2035 underscores the potential for continued expansion in this sector.

Regulatory Support for CBD Cultivation

Regulatory frameworks supporting CBD cultivation play a crucial role in shaping the Global CBD Plant Nutrients Market Industry. Governments worldwide are increasingly recognizing the potential economic benefits of CBD, leading to the establishment of favorable regulations. This regulatory support encourages farmers to engage in CBD cultivation, thereby driving the demand for specialized plant nutrients. As regulations continue to evolve, the market is expected to witness substantial growth, with projections indicating a compound annual growth rate of 41.53% from 2025 to 2035. This growth reflects the increasing legitimacy of CBD as a viable agricultural product.

Consumer Preference for Organic Products

The Global CBD Plant Nutrients Market Industry is significantly influenced by the rising consumer preference for organic and sustainably sourced products. As consumers become more environmentally conscious, there is a growing demand for organic CBD products, which necessitates the use of organic plant nutrients. This trend is likely to drive the market for CBD plant nutrients, as producers seek to meet consumer expectations for quality and sustainability. The emphasis on organic farming practices may lead to innovations in nutrient formulations, further enhancing the market's appeal and potential for growth in the coming years.

Technological Advancements in Agriculture

Technological innovations in agriculture significantly impact the Global CBD Plant Nutrients Market Industry. The adoption of precision agriculture techniques and advanced nutrient delivery systems enhances the efficiency of CBD cultivation. These technologies enable farmers to optimize nutrient application, leading to improved crop yields and quality. As a result, the market for CBD plant nutrients is likely to expand, driven by the need for effective nutrient management solutions. The integration of data analytics and IoT in farming practices may further streamline operations, potentially increasing the market's value as producers seek to maximize their returns on investment.