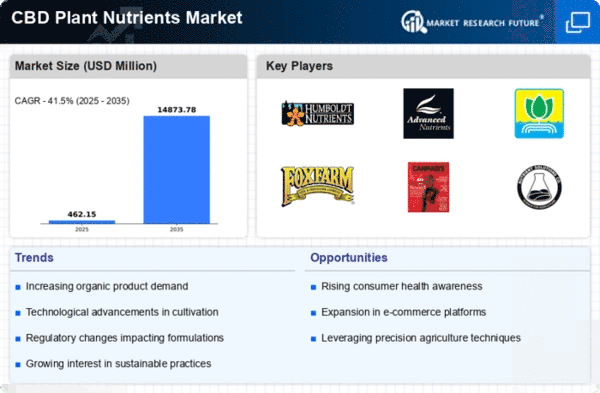

Top Industry Leaders in the CBD Plant Nutrients Market

CBD Plant Nutrients Market OverviewThe world's first cannabis-derived nutraceutical products, brands, and supply chain were introduced by Medical Marijuana, Inc., the first publicly traded cannabis company in the United States, in 2023. The company recently announced that its subsidiary HempMeds® Brasil had introduced two new full spectrum products in Brazil. The two goods give the subsidiary more market potential because they are the most reasonably priced options in the area.

CBD Plant Nutrients Market OverviewThe world's first cannabis-derived nutraceutical products, brands, and supply chain were introduced by Medical Marijuana, Inc., the first publicly traded cannabis company in the United States, in 2023. The company recently announced that its subsidiary HempMeds® Brasil had introduced two new full spectrum products in Brazil. The two goods give the subsidiary more market potential because they are the most reasonably priced options in the area.

British Cannabis presents its line of non-novel CBD supplements this quarter in 2023. You can be certain of a wider range of cannabis-associated advantages than CBD alone because the full spectrum, whole plant cannabis oils, capsules, and gummies currently available in the range mimic the complex phytochemical profile of the cannabis plant.

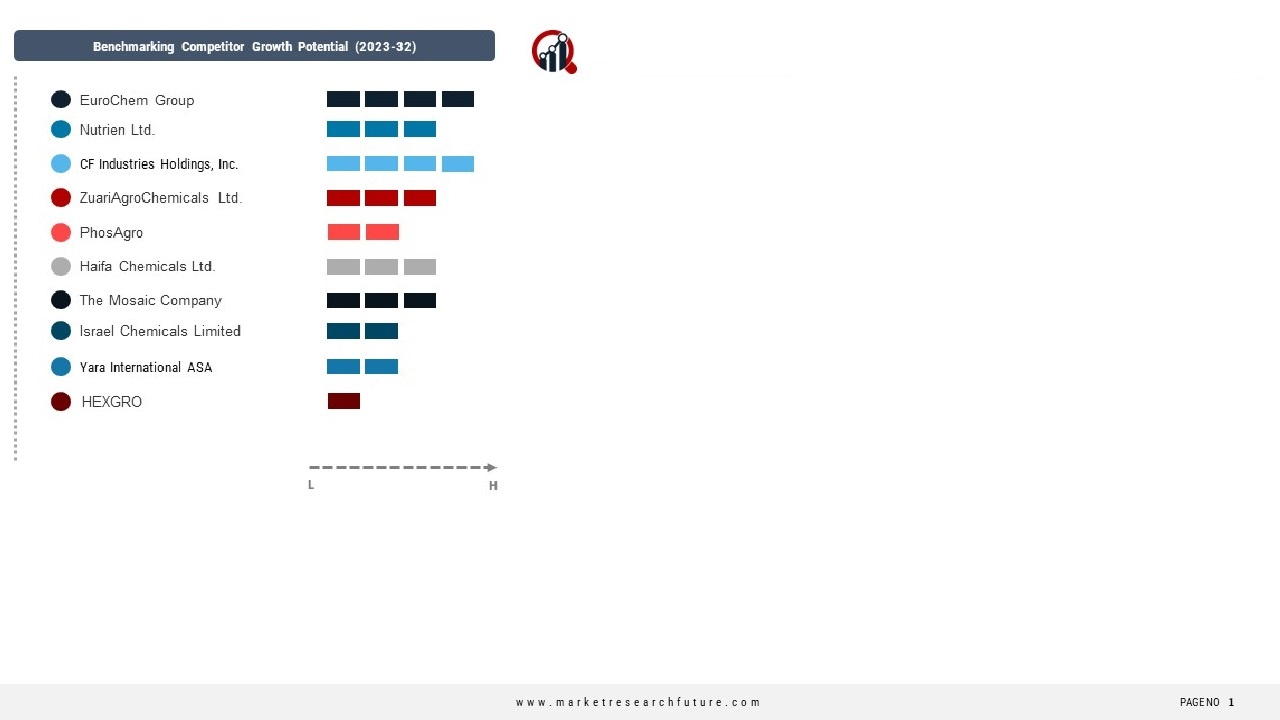

The leaders of the European hemp movement want to launch a fresh front in the ongoing fight for the reclassification of cannabidiol (CBD) as a traditional food in 2023. After the Ministry of Agriculture in the Czech Republic announced that it intended to outlaw CBD-containing products, the European Industrial Hemp Association (EIHA) decided to take action. This came after the European Commission (EC) decided in June of last year to stop processing applications for CBD Novel Foods because of worries about the oil's safety profile. As a result, EIHA has now submitted an Article 4 under the EC's Novel Food laws to request clarity on the traditional status of natural goods containing hemp extract.Some of the CBD Plant Nutrients Companies listed below:EuroChem Group, Sociedad Química y Minera de Chile, Nutrien Ltd., CF Industries Holdings, Inc., ZuariAgroChemicals Ltd., PhosAgro, Haifa Chemicals Ltd., The Mosaic Company