Carrageenan Size

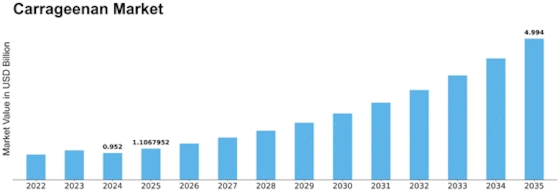

Carrageenan Market Growth Projections and Opportunities

The Carrageenan market is influenced by a myriad of factors that collectively determine its dynamics. One pivotal factor is the expanding food and beverage industry, as carrageenan, a natural thickening and gelling agent derived from seaweed, finds extensive use in various processed foods. The market is particularly sensitive to changes in consumer preferences for convenience foods and the demand for plant-based alternatives, as carrageenan is often utilized in vegetarian and vegan products as a substitute for animal-derived ingredients.

Global economic conditions play a significant role in shaping the Carrageenan market. Economic fluctuations can impact consumer purchasing power and influence spending patterns on processed and packaged foods, directly affecting the demand for carrageenan. During periods of economic growth, consumers may be more inclined to purchase convenience foods, while economic downturns may lead to a shift towards more budget-friendly options.

Regulatory standards and compliance are critical market factors for carrageenan. As a food additive, carrageenan is subject to regulations governing its safety and usage in various countries. Changes in regulatory frameworks can impact the approval status and market accessibility of carrageenan-containing products. Ensuring compliance with these standards is essential for businesses operating in the carrageenan market to maintain consumer trust and adhere to legal requirements.

Innovation and technological advancements also contribute to the market dynamics of carrageenan. Ongoing research and development efforts lead to the discovery of new applications and formulations for carrageenan in the food industry. This includes advancements in texture modification, stabilization, and the creation of novel food products, driving market growth and diversification.

Environmental sustainability concerns play an increasingly important role in the carrageenan market. As consumers become more environmentally conscious, there is a growing demand for sustainably sourced and produced ingredients. The seaweed farming practices for carrageenan extraction need to align with eco-friendly standards to meet consumer expectations and address concerns related to environmental impact.

International trade dynamics and geopolitical factors influence the carrageenan market. The availability of seaweed resources, trade agreements, and geopolitical stability in key seaweed-producing regions impact the supply chain of carrageenan. Changes in global trade policies can affect the cost and availability of carrageenan, affecting manufacturers and suppliers in the market.

Market competition is intense, with companies focusing on branding, product differentiation, and strategic collaborations. Manufacturers often engage in research and development to enhance the quality and functionality of carrageenan-based products. Marketing efforts, including advertising campaigns and partnerships with food processors, contribute to brand visibility and market share.

Consumer awareness and perception of carrageenan also impact the market. While carrageenan has been widely used as a food additive for decades, concerns about its safety have arisen, leading some consumers to seek carrageenan-free alternatives. Clear communication about the safety and benefits of carrageenan, backed by scientific evidence, is crucial for companies to address consumer apprehensions and maintain the positive image of carrageenan in the market.

Leave a Comment