Increasing Trade Volumes

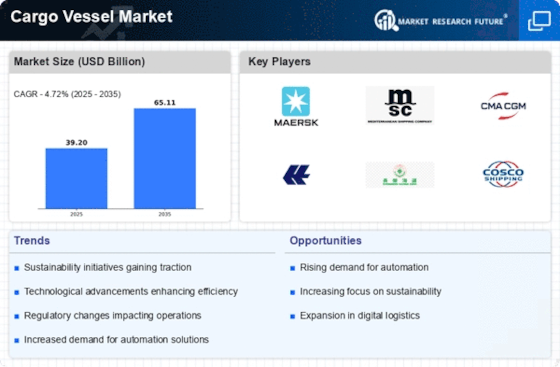

The cargo vessel Market is experiencing a notable surge in trade volumes, driven by the expansion of international trade agreements and the growing demand for goods across various sectors. As economies recover and consumer spending rises, the need for efficient cargo transportation becomes paramount. In 2025, the total volume of goods transported by sea is projected to reach approximately 12 billion tons, indicating a robust growth trajectory. This increase in trade volumes necessitates a corresponding rise in cargo vessel capacity, thereby stimulating investments in new vessels and fleet upgrades. Consequently, shipping companies are likely to enhance their operational efficiencies to meet the rising demand, further propelling the Cargo Vessel Market.

Technological Advancements

Technological innovations are reshaping the Cargo Vessel Market, with advancements in automation, navigation systems, and fuel efficiency playing pivotal roles. The integration of digital technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is enhancing operational efficiencies and safety standards. For instance, the adoption of smart shipping solutions is expected to reduce operational costs by up to 20% by 2026. Furthermore, the development of eco-friendly vessels, utilizing alternative fuels and energy-efficient designs, aligns with the industry's sustainability goals. These technological advancements not only improve the competitiveness of shipping companies but also contribute to the overall growth of the Cargo Vessel Market.

Rising Demand for E-commerce

The Cargo Vessel Market is witnessing a significant impact from the rising demand for e-commerce, which has transformed logistics and shipping dynamics. As online shopping continues to gain traction, the volume of goods requiring transportation has surged. In 2025, e-commerce sales are projected to exceed 5 trillion dollars, necessitating efficient cargo shipping solutions to meet consumer expectations for timely deliveries. This trend is prompting shipping companies to adapt their operations, optimizing routes and increasing vessel capacities to accommodate the growing e-commerce sector. Consequently, the Cargo Vessel Market is likely to experience sustained growth as it aligns with the evolving needs of the e-commerce landscape.

Infrastructure Development and Investment

Infrastructure development plays a crucial role in shaping the Cargo Vessel Market, as investments in ports, terminals, and shipping lanes enhance operational capabilities. Governments and private entities are increasingly recognizing the importance of modernizing port facilities to accommodate larger vessels and improve efficiency. In 2025, global investments in port infrastructure are expected to reach approximately 100 billion dollars, reflecting a commitment to enhancing maritime logistics. Improved infrastructure not only facilitates smoother cargo handling but also reduces turnaround times for vessels, thereby increasing overall productivity. This focus on infrastructure development is likely to bolster the Cargo Vessel Market, as it supports the growing demand for efficient and reliable shipping services.

Regulatory Compliance and Environmental Standards

The Cargo Vessel Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments and international organizations are implementing regulations aimed at reducing emissions and promoting sustainable practices within the shipping sector. The International Maritime Organization (IMO) has set ambitious targets for reducing greenhouse gas emissions by at least 50% by 2050. As a result, shipping companies are compelled to invest in cleaner technologies and retrofitting existing vessels to comply with these regulations. This shift towards sustainability not only enhances the reputation of shipping companies but also opens new avenues for growth within the Cargo Vessel Market, as environmentally conscious consumers and businesses seek greener shipping options.