North America : Leading Market Innovator

North America is poised to maintain its leadership in the Cargo Vessel Maintenance and Overhaul Services Market, holding a significant market share of 12.6 in 2024. The region's growth is driven by increasing trade activities, stringent regulatory standards, and advancements in maritime technology. The demand for efficient and sustainable shipping solutions is further catalyzed by government initiatives aimed at enhancing maritime infrastructure and safety regulations.

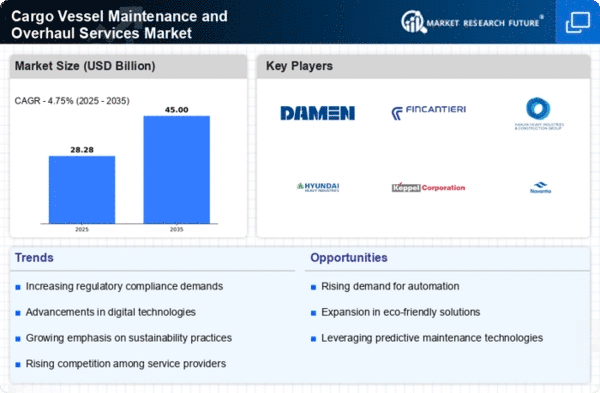

The competitive landscape in North America is characterized by the presence of major players such as Damen Shipyards Group and Wärtsilä Corporation. The U.S. and Canada are the leading countries, with robust shipbuilding and repair facilities. The market is also supported by a skilled workforce and significant investments in research and development, ensuring that North America remains at the forefront of innovation in cargo vessel services.

Europe : Strategic Maritime Hub

Europe's Cargo Vessel Maintenance and Overhaul Services Market is projected to reach a size of 8.1 by 2025, driven by a strong focus on sustainability and technological advancements. The region benefits from stringent environmental regulations that encourage the adoption of eco-friendly practices in shipping. Additionally, the European Union's initiatives to enhance maritime safety and efficiency are pivotal in shaping market dynamics, fostering a competitive environment for service providers.

Leading countries such as Germany, Italy, and the Netherlands are home to key players like Fincantieri S.p.A. and ThyssenKrupp Marine Systems. The competitive landscape is marked by collaborations between shipyards and technology firms, enhancing service offerings. The presence of established maritime clusters in these countries further strengthens Europe's position as a strategic hub for cargo vessel maintenance and overhaul services.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Cargo Vessel Maintenance and Overhaul Services Market, projected to reach 5.4 by 2025. This growth is fueled by increasing shipping activities, particularly in countries like China and South Korea, which are major players in global trade. The region's expanding economies and rising demand for efficient logistics solutions are key drivers, alongside supportive government policies aimed at enhancing maritime infrastructure.

China and South Korea lead the market, with companies like Hanjin Heavy Industries and Hyundai Heavy Industries playing crucial roles. The competitive landscape is evolving, with a mix of established firms and emerging players. Investments in technology and innovation are essential for meeting the growing demand for maintenance and overhaul services, positioning Asia-Pacific as a vital player in the global market.

Middle East and Africa : Developing Maritime Landscape

The Middle East and Africa region is gradually emerging in the Cargo Vessel Maintenance and Overhaul Services Market, with a projected size of 1.9 by 2025. The growth is driven by increasing trade routes and investments in port infrastructure. Countries like the UAE and South Africa are focusing on enhancing their maritime capabilities, supported by government initiatives aimed at boosting economic diversification and trade facilitation.

The competitive landscape is still developing, with local players beginning to establish their presence. The region's strategic location along key shipping routes offers significant opportunities for growth. As investments in maritime infrastructure continue, the Middle East and Africa are expected to attract more international players, enhancing the overall service offerings in the cargo vessel sector.