Cardiac Valve Size

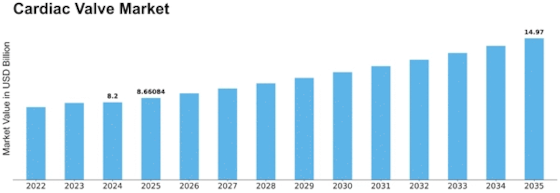

Cardiac Valve Market Growth Projections and Opportunities

The cardiac valve market is affected by the global aging population, which is more likely to develop heart disease. Age increases the risk of cardiac disorders such valvular illnesses. More cardiac valve interventions are needed. New technology improves heart valve designs, affecting the market. Transcatheter aortic valve replacement (TAVR) and tissue-engineered valves improve cardiac valve treatments, making them more effective, long-lasting, and slightly invasive, affecting market trends. Common heart valve issues including aortic stenosis and mitral regurgitation drive the market. Learning about valve problems and better diagnosis is leading to more valve replacement surgeries. This alters the market. Being less active, eating badly, and being stressed all increase heart disease risk. Risk factors increase valvular disorders. This boosts heart valve therapy demand, which benefits the industry. The market is affected by heart operations that cause less damage. Doctors and patients choose therapies with quicker recovery times and fewer side effects. TAVR and other low-damage methods boost the market. Valve replacements are easier to get due to globalization. The global heart valve market is growing as new technologies aid patients worldwide. Government approvals and safety regulations impact the heart valve market. Market health is affected by manufacturers who focus on regulatory compliance, which boosts cardiac valve product credibility and reliability. Patients like bioprosthetic valves, which helps the industry. Bioprosthetic valves are preferable over mechanical valves since they don't need long-term anticoagulation medication and are safer. 3D echocardiography and cardiac MRI enhance planning and assessment before and after heart valve surgery. These instruments improve valve replacement procedures, changing market patterns. Markets are affected by heart health education programs. Knowing the indications and symptoms of valvular disorders helps people recognize and treat them early, changing heart valve therapy demand. Cost and accessibility of heart valve procedures affect the market. New cardiac valve technologies improve performance, but cheaper options are needed for widespread usage, especially in cost-conscious healthcare systems. Market toughness and industry collaboration effect market trends. Research and development improves with acquisitions, mergers, and collaborations. This improves heart valve technologies and affects the market.

Leave a Comment