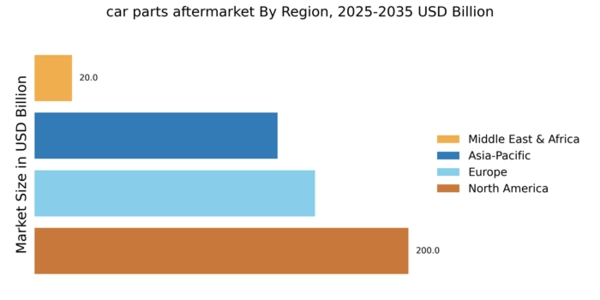

North America : Market Leader in Car Parts

North America continues to lead the car parts aftermarket market, holding a significant share of 200.0 million. The growth is driven by increasing vehicle ownership, a rise in the average age of vehicles, and a growing trend towards DIY repairs. Regulatory support for automotive safety and emissions standards further fuels demand for quality aftermarket parts. The region's robust logistics and distribution networks also enhance market accessibility. The competitive landscape is characterized by major players such as AutoZone, Advance Auto Parts, and O'Reilly Automotive, which dominate the market. The U.S. remains the largest contributor, with Canada also showing promising growth. The presence of international brands like Denso and Bosch adds to the competitive dynamics, ensuring a diverse range of products for consumers.

Europe : Emerging Market Dynamics

Europe's car parts aftermarket market is valued at 150.0 million, driven by a strong focus on sustainability and regulatory compliance. The European Union's stringent regulations on vehicle emissions and safety standards are significant catalysts for growth. Additionally, the increasing trend of vehicle electrification and the demand for high-quality aftermarket parts are shaping the market landscape. The region is witnessing a shift towards online sales channels, enhancing consumer access to parts. Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Valeo and Bosch. The presence of established distribution networks and a growing number of independent retailers contribute to market dynamics. As the automotive sector evolves, the aftermarket is expected to adapt, focusing on innovation and customer service.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific car parts aftermarket market, valued at 130.0 million, is experiencing rapid growth driven by increasing vehicle ownership and urbanization. The region's expanding middle class is leading to higher disposable incomes, which in turn boosts demand for aftermarket parts. Additionally, government initiatives promoting vehicle safety and environmental standards are catalyzing market growth. The rise of e-commerce platforms is also transforming how consumers access car parts, making them more readily available. Countries like China, Japan, and India are leading the charge in this market, with a competitive landscape featuring both local and international players. Companies such as Denso and Magna International are key contributors, while local manufacturers are increasingly gaining market share. The region's diverse automotive landscape presents numerous opportunities for innovation and growth in the aftermarket sector.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa car parts aftermarket market is valued at 20.0 million, showing potential for significant growth. Factors such as increasing vehicle ownership, urbanization, and a growing population are driving demand for aftermarket parts. Additionally, the region's focus on improving road infrastructure and vehicle safety regulations is expected to further stimulate market growth. The rise of online retailing is also making it easier for consumers to access a variety of car parts. Leading countries in this region include South Africa and the UAE, where the automotive market is expanding rapidly. The competitive landscape features both local and international players, with companies like Tenneco and Valeo establishing a presence. As the market matures, there is a growing emphasis on quality and customer service, which will shape the future of the aftermarket sector.