Regulatory Changes and Compliance

The Car Insurance Aggregators Market is also shaped by evolving regulatory frameworks that govern the insurance sector. Governments are increasingly focusing on consumer protection and transparency, leading to new regulations that impact how insurance products are marketed and sold. For instance, recent legislation has mandated clearer disclosures regarding policy terms and pricing, which benefits consumers by enhancing their understanding of insurance products. This regulatory environment encourages aggregators to adopt best practices in compliance, thereby building trust with users. As the industry adapts to these changes, the Car Insurance Aggregators Market is likely to see growth, as compliant aggregators can attract more customers seeking reliable and transparent insurance solutions.

Rising Demand for Digital Solutions

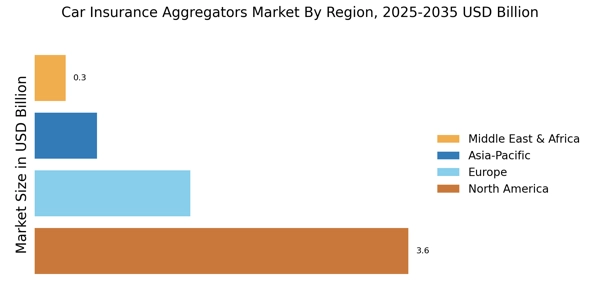

The Car Insurance Aggregators Market is experiencing a notable surge in demand for digital solutions. As consumers increasingly prefer online platforms for purchasing insurance, aggregators are positioned to capitalize on this trend. The convenience of comparing multiple policies and prices in one place appeals to tech-savvy customers. According to recent data, the online insurance segment has seen a growth rate of approximately 15% annually, indicating a shift in consumer behavior towards digital channels. This trend is likely to continue, as more individuals seek efficient and user-friendly ways to manage their insurance needs. Consequently, the Car Insurance Aggregators Market is expected to expand, driven by the integration of advanced technologies that enhance user experience and streamline the purchasing process.

Increased Competition Among Insurers

The Car Insurance Aggregators Market is significantly influenced by the heightened competition among insurance providers. As more companies enter the market, they are compelled to offer competitive pricing and innovative products to attract customers. This competitive landscape benefits consumers, who gain access to a wider array of options and potentially lower premiums. Data suggests that the number of insurance providers has increased by over 20% in recent years, leading to a more dynamic market environment. Aggregators play a crucial role in this scenario by enabling consumers to easily compare offerings from various insurers. As competition intensifies, the Car Insurance Aggregators Market is likely to thrive, fostering an ecosystem where consumers are empowered to make informed decisions.

Growing Awareness of Insurance Importance

The Car Insurance Aggregators Market is benefiting from a growing awareness of the importance of insurance among consumers. As individuals recognize the financial risks associated with vehicle ownership, there is an increasing inclination to secure adequate coverage. Educational campaigns and outreach initiatives have contributed to this heightened awareness, leading to a rise in insurance penetration rates. Recent statistics indicate that insurance penetration in the automotive sector has increased by approximately 10% over the past few years. This trend is likely to continue, as more consumers seek to protect themselves against unforeseen events. Consequently, the Car Insurance Aggregators Market is poised for growth, as aggregators provide essential resources and information to help consumers make informed insurance choices.

Shift Towards Personalized Insurance Products

The Car Insurance Aggregators Market is witnessing a shift towards personalized insurance products tailored to individual needs. As consumers become more discerning, they seek coverage that aligns with their specific circumstances, such as driving habits and lifestyle choices. This trend is supported by advancements in data analytics and artificial intelligence, which enable insurers to offer customized solutions. Research indicates that personalized insurance products can lead to higher customer satisfaction and retention rates. Aggregators are well-positioned to facilitate this trend by providing platforms that allow consumers to find and compare personalized options. As the demand for tailored insurance solutions grows, the Car Insurance Aggregators Market is expected to expand, driven by the increasing emphasis on customer-centric offerings.