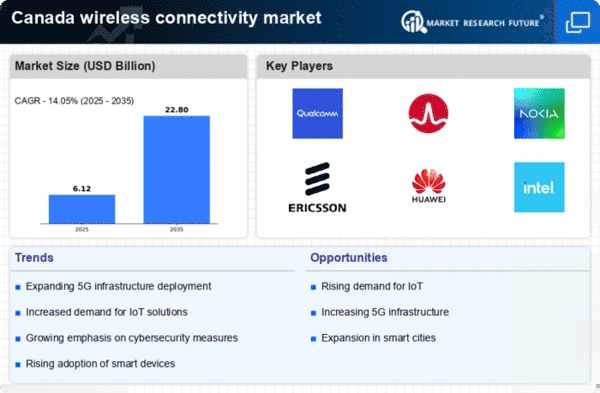

Growing Cybersecurity Concerns

As the wireless connectivity market in Canada expands, so do concerns regarding cybersecurity. With the increasing number of connected devices and the rise of IoT applications, vulnerabilities in wireless networks have become more pronounced. Businesses and consumers alike are becoming more aware of the potential risks associated with inadequate security measures. This heightened awareness is prompting investments in advanced cybersecurity solutions tailored for wireless networks. Service providers are likely to respond by enhancing their security protocols and offering comprehensive solutions to protect users. Consequently, the focus on cybersecurity may drive innovation and growth within the wireless connectivity market, as stakeholders seek to ensure safe and secure connectivity.

Rising Mobile Data Consumption

The wireless connectivity market in Canada is experiencing a notable surge in mobile data consumption. With the proliferation of smartphones and mobile devices, Canadians are increasingly relying on wireless networks for various applications, including streaming, gaming, and social media. Recent statistics indicate that mobile data traffic in Canada is projected to grow at a CAGR of approximately 30% over the next five years. This escalating demand for high-speed mobile data is driving investments in infrastructure and technology, thereby enhancing the overall wireless connectivity market. As consumers seek faster and more reliable connections, service providers are compelled to upgrade their networks, which may lead to increased competition and innovation within the industry.

Increased Remote Work and Learning

The shift towards remote work and online learning has significantly impacted the wireless connectivity market in Canada. As businesses and educational institutions adapt to new operational models, the demand for reliable and high-speed internet connectivity has surged. Reports suggest that approximately 40% of Canadians are now working remotely, necessitating robust wireless solutions to support seamless communication and collaboration. This trend is likely to persist, as many organizations embrace hybrid work models. Consequently, service providers are focusing on enhancing their wireless offerings to meet the evolving needs of consumers and businesses alike. This growing reliance on wireless connectivity for work and education is expected to drive sustained growth in the market.

Advancements in Wireless Technologies

Technological advancements are playing a pivotal role in shaping the wireless connectivity market in Canada. Innovations such as Wi-Fi 6 and the ongoing rollout of 5G technology are enhancing network performance and capacity. These advancements enable faster data transfer rates and improved connectivity for a growing number of devices. The Canadian government has been supportive of these developments, facilitating research and development initiatives that aim to bolster the wireless infrastructure. As a result, the market is likely to witness a shift towards more efficient and robust wireless solutions, catering to both consumer and enterprise needs. This technological evolution is expected to drive growth and create new opportunities within the wireless connectivity market.

Expansion of Smart Cities Initiatives

The development of smart cities in Canada is emerging as a significant driver for the wireless connectivity market. Municipalities are increasingly investing in smart technologies to improve urban living, enhance public services, and promote sustainability. This includes the deployment of smart sensors, connected infrastructure, and IoT applications that require robust wireless connectivity. As cities strive to become more efficient and responsive, the demand for reliable wireless networks is likely to increase. Government initiatives aimed at fostering smart city projects may further stimulate investments in the wireless connectivity market, creating opportunities for service providers to expand their offerings and enhance network capabilities.