Growing E-commerce Sector

The expansion of the e-commerce sector in Canada is a pivotal driver for the web application-firewall market. With online retail sales projected to surpass $50 billion in 2025, businesses are increasingly investing in security solutions to protect their online transactions and customer data. The rise in e-commerce activities has led to a corresponding increase in cyber threats, making web application firewalls essential for safeguarding sensitive information. As consumers become more aware of data privacy issues, companies are compelled to implement robust security measures to maintain customer trust and loyalty. This trend is likely to propel the web application-firewall market forward, as organizations prioritize the protection of their e-commerce platforms.

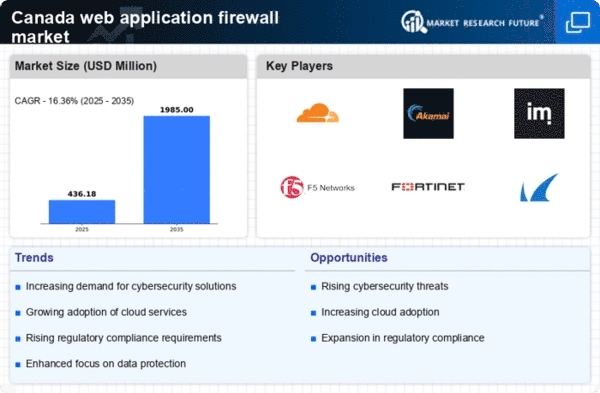

Rising Cybersecurity Threats

The web application-firewall market in Canada is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of robust security measures to protect sensitive data and maintain customer trust. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually. This alarming trend compels companies to invest in web application firewalls as a primary defense mechanism against attacks such as SQL injection and cross-site scripting. The heightened awareness of cybersecurity risks is driving demand for advanced firewall solutions, which are essential for safeguarding web applications and ensuring compliance with regulatory standards. As a result, the web application-firewall market is likely to expand significantly in response to these evolving threats.

Regulatory Compliance Requirements

In Canada, stringent regulatory frameworks are shaping the web application-firewall market. Organizations are increasingly required to comply with laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA) and the Digital Privacy Act. These regulations mandate the protection of personal data, which necessitates the implementation of effective security measures, including web application firewalls. As businesses strive to meet compliance standards, the demand for firewall solutions is expected to rise. In 2025, it is projected that compliance-related investments in cybersecurity could reach $5 billion in Canada. This regulatory landscape is compelling organizations to prioritize the deployment of web application firewalls, thereby driving market growth and enhancing overall data protection.

Increased Investment in IT Security

In Canada, there is a notable increase in investment in IT security, which is significantly impacting the web application-firewall market. Organizations are allocating larger portions of their budgets to cybersecurity measures, with estimates suggesting that IT security spending could reach $20 billion by 2025. This trend reflects a growing recognition of the importance of protecting digital assets and infrastructure. As businesses face mounting pressure to defend against cyber threats, the demand for web application firewalls is expected to rise. These solutions are viewed as critical components of a comprehensive security strategy, leading to a robust growth trajectory for the web application-firewall market in the coming years.

Shift Towards Digital Transformation

The ongoing digital transformation across various sectors in Canada is significantly influencing the web application-firewall market. As businesses increasingly migrate to online platforms and adopt digital services, the need for enhanced security measures becomes paramount. In 2025, it is anticipated that over 70% of Canadian enterprises will have transitioned to cloud-based solutions, creating a pressing demand for web application firewalls to protect these digital assets. This shift not only enhances operational efficiency but also exposes organizations to new vulnerabilities. Consequently, the web application-firewall market is likely to see a surge in demand as companies seek to secure their web applications against potential threats arising from digital transformation initiatives.