Growing Demand for 5G Connectivity

The increasing demand for 5G connectivity in Canada is a primary driver for the virtualized evolved-packet-core market. As telecommunications companies expand their 5G networks, the need for efficient and scalable core network solutions becomes paramount. The virtualized evolved-packet-core market is poised to benefit from this trend, as it offers the flexibility and performance required to support high-speed data transmission. According to recent estimates, the 5G subscriber base in Canada is expected to reach approximately 20 million by 2026, indicating a substantial growth trajectory. This surge in demand necessitates the deployment of advanced core network technologies, thereby propelling the virtualized evolved-packet-core market forward.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a crucial factor driving the virtualized evolved-packet-core market in Canada. Telecommunications providers are increasingly seeking solutions that reduce operational costs while enhancing service delivery. Virtualized evolved-packet-core solutions enable operators to optimize resource utilization and minimize capital expenditures. By leveraging cloud-based architectures, companies can achieve significant savings, with reports suggesting potential reductions in operational costs by up to 30%. This financial incentive encourages the adoption of virtualized solutions, as operators aim to remain competitive in a rapidly evolving market. The operational flexibility offered by these solutions further enhances their appeal, allowing for rapid deployment and scalability in response to changing market demands.

Regulatory Support for Network Modernization

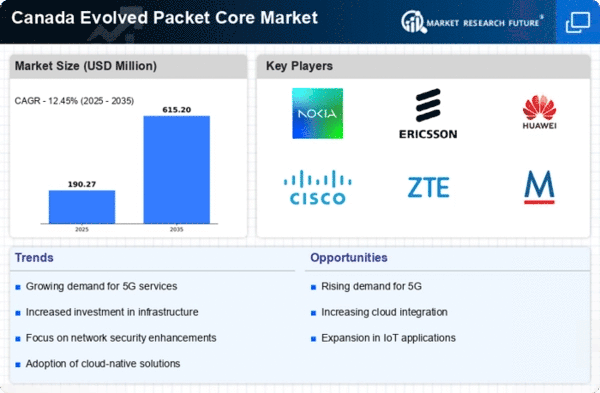

Regulatory bodies in Canada are actively promoting network modernization initiatives, which serve as a catalyst for the virtualized evolved-packet-core market. The Canadian Radio-television and Telecommunications Commission (CRTC) has implemented policies aimed at encouraging the adoption of advanced telecommunications technologies. These initiatives are designed to enhance network resilience and improve service quality across the country. As operators align with regulatory expectations, the demand for virtualized evolved-packet-core solutions is likely to increase. The market is expected to witness a compound annual growth rate (CAGR) of around 15% over the next five years, driven by these supportive regulatory frameworks that facilitate the transition to more efficient network architectures.

Rising IoT Applications and Connectivity Needs

The proliferation of Internet of Things (IoT) applications in Canada is significantly influencing the virtualized evolved-packet-core market. As more devices become interconnected, the demand for robust and scalable network solutions intensifies. Virtualized evolved-packet-core technologies are well-suited to handle the diverse connectivity requirements of IoT applications, providing the necessary bandwidth and low latency. Industry forecasts indicate that the number of connected IoT devices in Canada could exceed 1 billion by 2027, creating a substantial opportunity for the virtualized evolved-packet-core market. This growth underscores the necessity for telecommunications providers to invest in advanced core network solutions that can accommodate the increasing data traffic generated by IoT devices.

Enhanced User Experience through Network Slicing

Network slicing is emerging as a transformative approach within the virtualized evolved-packet-core market, particularly in Canada. This technology allows operators to create multiple virtual networks on a single physical infrastructure, tailored to specific user requirements. By implementing network slicing, telecommunications providers can enhance user experience by delivering customized services with guaranteed performance levels. This capability is particularly relevant in sectors such as healthcare, automotive, and entertainment, where distinct service quality is essential. As the demand for personalized services grows, the virtualized evolved-packet-core market is likely to expand, with operators investing in solutions that support network slicing to meet diverse customer needs.