Expansion of Data Centers

The expansion of data centers in Canada is a pivotal driver for the structured cabling market. As businesses increasingly rely on cloud computing and data storage solutions, the demand for robust cabling infrastructure intensifies. In 2025, the data center market in Canada is projected to reach approximately $5 billion, indicating a substantial growth trajectory. This expansion necessitates advanced structured cabling systems to support high data transfer rates and ensure reliable connectivity. Furthermore, the trend towards edge computing is likely to amplify the need for localized data centers, further driving the structured cabling market. The integration of high-capacity fiber optic cables and efficient cable management systems becomes essential to meet the growing demands of data centers, thereby enhancing the overall performance and reliability of network infrastructures.

Growth of Smart Buildings

The growth of smart buildings in Canada is a significant driver for the structured cabling market. As urbanization continues to rise, the demand for intelligent building solutions that enhance energy efficiency and occupant comfort is increasing. Smart buildings rely heavily on structured cabling systems to support various technologies, including IoT devices, security systems, and energy management solutions. By 2025, the smart building market in Canada is projected to reach $10 billion, indicating a robust growth potential. This trend necessitates the implementation of advanced cabling infrastructures that can accommodate the diverse range of connected devices and systems. Consequently, the structured cabling market is likely to benefit from this shift towards smart building technologies, as organizations seek to create more efficient and interconnected environments.

Increased Internet Penetration

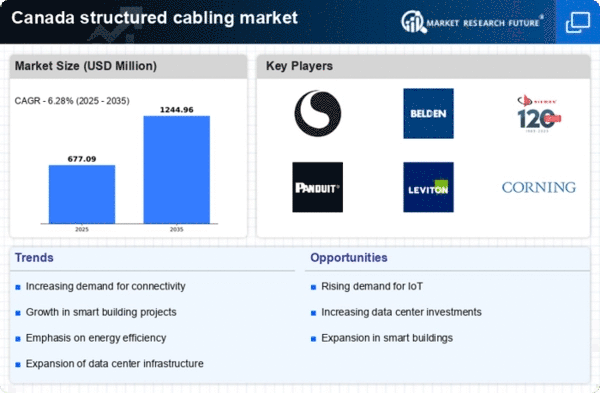

The increasing internet penetration in Canada significantly influences the structured cabling market. With over 90% of Canadian households having internet access as of 2025, the demand for high-quality cabling solutions is on the rise. This surge in connectivity requirements compels businesses and residential sectors to invest in structured cabling systems that can support high-speed internet and seamless connectivity. The structured cabling market is expected to grow at a CAGR of around 8% over the next five years, driven by the need for reliable and efficient network infrastructures. As more Canadians engage in remote work and online activities, the emphasis on robust cabling solutions becomes paramount. Consequently, the structured cabling market is poised to benefit from this trend, as organizations seek to enhance their network capabilities to accommodate the growing number of connected devices.

Regulatory Compliance and Standards

Regulatory compliance and standards play a crucial role in shaping the structured cabling market in Canada. As industries face increasing scrutiny regarding data security and network reliability, adherence to established cabling standards becomes essential. The structured cabling market is influenced by regulations set forth by organizations such as the Canadian Standards Association (CSA) and the Telecommunications Industry Association (TIA). Compliance with these standards ensures that cabling systems meet safety and performance criteria, thereby enhancing the overall integrity of network infrastructures. In 2025, it is anticipated that companies investing in structured cabling solutions will prioritize compliance, driving market growth. This focus on regulatory adherence not only mitigates risks but also fosters consumer confidence in network reliability, further propelling the structured cabling market.

Technological Advancements in Cabling Solutions

Technological advancements in cabling solutions are propelling the structured cabling market forward in Canada. Innovations such as Category 6A and Category 7 cables offer enhanced performance, supporting higher bandwidths and faster data transmission rates. As businesses adopt these advanced cabling solutions, the structured cabling market is likely to experience a surge in demand. In 2025, the market for high-performance cabling is expected to account for approximately 40% of the overall structured cabling market. These advancements not only improve network efficiency but also reduce installation time and costs. Moreover, the integration of smart technologies into cabling systems, such as intelligent cable management and monitoring solutions, further enhances the appeal of structured cabling. This trend indicates a shift towards more sophisticated and efficient network infrastructures, positioning the structured cabling market for sustained growth.