Emergence of Edge Computing

Edge computing is emerging as a transformative force within the servers market in Canada. As businesses seek to process data closer to its source, the demand for edge servers is expected to rise significantly. By 2025, the edge computing market in Canada is projected to grow by approximately 20%, driven by the proliferation of IoT devices and the need for real-time data processing. This shift towards decentralized computing architectures is likely to create new opportunities for server manufacturers and service providers. The servers market must adapt to this trend by offering solutions that cater to the unique requirements of edge computing environments.

Growing Cybersecurity Concerns

Cybersecurity remains a pressing issue for organizations across Canada, influencing the servers market. As cyber threats become increasingly sophisticated, businesses are compelled to invest in secure server solutions. In 2025, it is anticipated that Canadian companies will allocate over $1 billion towards enhancing their cybersecurity infrastructure. This heightened focus on security is likely to drive demand for servers equipped with advanced security features, such as encryption and intrusion detection systems. Consequently, the servers market must evolve to meet these security demands, ensuring that organizations can protect their sensitive data effectively.

Rising Data Center Investments

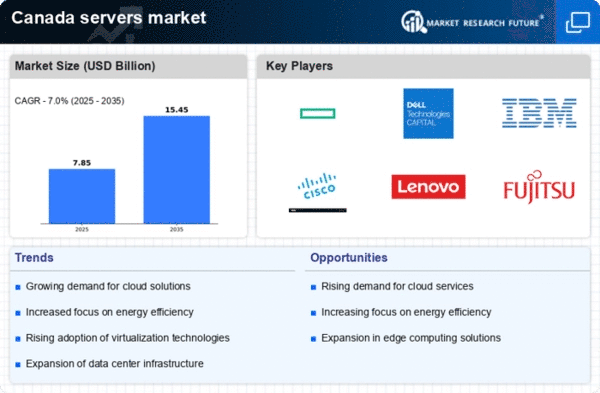

The servers market in Canada is experiencing a notable surge in data center investments. Companies are increasingly recognizing the necessity of robust infrastructure to support their digital operations. In 2025, the Canadian data center market is projected to reach approximately $3 billion, reflecting a growth rate of around 15% annually. This investment trend is driven by the need for enhanced storage capabilities and improved processing power. As organizations expand their digital footprints, the demand for high-performance servers becomes critical. Consequently, this influx of capital into data centers is likely to bolster the servers market, as businesses seek to upgrade their existing systems and adopt cutting-edge technologies.

Increased Demand for Virtualization

Virtualization technology is becoming a cornerstone of the servers market in Canada. Organizations are increasingly adopting virtualization to optimize resource utilization and reduce operational costs. By 2025, it is estimated that over 60% of Canadian enterprises will implement virtualization solutions, leading to a significant increase in server demand. This trend is indicative of a broader shift towards agile IT environments, where businesses can scale their operations efficiently. The servers market is likely to benefit from this growing preference for virtualized environments, as companies seek to enhance their flexibility and responsiveness to market changes.

Shift Towards Hybrid IT Environments

The transition to hybrid IT environments is reshaping the servers market in Canada. Organizations are increasingly adopting a mix of on-premises and cloud-based solutions to optimize their IT strategies. By 2025, it is projected that over 50% of Canadian enterprises will operate in hybrid environments, necessitating a diverse range of server solutions. This shift is driven by the desire for flexibility, scalability, and cost-effectiveness. As businesses navigate this hybrid landscape, the servers market is likely to see a surge in demand for servers that can seamlessly integrate with both cloud and on-premises infrastructures.