Rising Focus on Industry 4.0

The industrial ethernet market in Canada is poised for growth due to the rising focus on Industry 4.0. This paradigm shift emphasizes the interconnectivity of machines, systems, and processes, fostering a more integrated and efficient manufacturing landscape. As Canadian industries increasingly adopt Industry 4.0 strategies, the demand for advanced networking solutions, including industrial ethernet, is likely to escalate. Market Research Future indicate that the transition to Industry 4.0 could result in productivity gains of up to 30% for manufacturers. This potential for enhanced efficiency and competitiveness drives investments in industrial ethernet technologies, which are essential for enabling seamless communication and data sharing across interconnected devices and systems.

Growing Demand for Automation

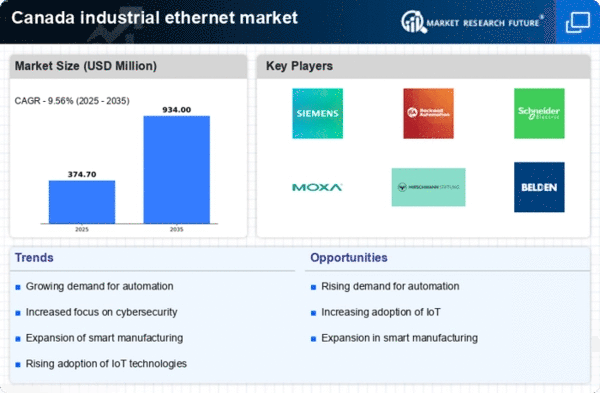

The industrial ethernet market in Canada experiences a notable surge in demand for automation technologies. As industries strive for enhanced efficiency and productivity, the integration of automated systems becomes paramount. This trend is particularly evident in manufacturing sectors, where automation can lead to significant cost savings and improved operational performance. According to recent data, the automation market in Canada is projected to grow at a CAGR of approximately 8% over the next five years. This growth directly influences the industrial ethernet market, as robust networking solutions are essential for seamless communication between automated devices. Consequently, the increasing reliance on automation technologies is likely to drive the adoption of industrial ethernet solutions, ensuring reliable and high-speed connectivity across various industrial applications.

Emphasis on Enhanced Data Security

The industrial ethernet market in Canada is increasingly influenced by the emphasis on enhanced data security. As industries become more interconnected, the risk of cyber threats escalates, prompting organizations to prioritize the protection of their networks. The implementation of robust cybersecurity protocols is essential for safeguarding sensitive data and ensuring operational continuity. In response to these challenges, many Canadian companies are investing in industrial ethernet solutions that offer advanced security features, such as encryption and secure access controls. This trend is likely to drive market growth, as organizations recognize the importance of securing their industrial networks against potential cyber threats. Analysts predict that the demand for secure industrial ethernet solutions could increase by over 20% in the coming years.

Expansion of Smart Manufacturing Initiatives

The industrial ethernet market in Canada is significantly impacted by the expansion of smart manufacturing initiatives. These initiatives aim to leverage advanced technologies such as IoT, AI, and big data analytics to optimize production processes. The Canadian government has been actively promoting smart manufacturing through various funding programs and incentives, which encourages industries to adopt innovative solutions. As a result, the market for industrial ethernet is expected to witness substantial growth, with estimates suggesting an increase in market size by over 15% in the next few years. The need for high-speed, reliable communication networks is critical in smart manufacturing environments, thereby driving the demand for industrial ethernet solutions that can support real-time data exchange and enhance operational efficiency.

Increased Investment in Infrastructure Development

The industrial ethernet market in Canada benefits from increased investment in infrastructure development across various sectors. Government initiatives aimed at modernizing industrial facilities and enhancing connectivity are driving this trend. For instance, substantial funding has been allocated to upgrade transportation, energy, and manufacturing infrastructures, which necessitates the implementation of reliable networking solutions. The industrial ethernet market is expected to grow as industries seek to integrate advanced communication technologies into their infrastructure projects. Recent reports suggest that infrastructure spending in Canada could reach approximately $200 billion over the next decade, creating a favorable environment for the adoption of industrial ethernet solutions that support high-speed data transmission and connectivity.