Rising Urbanization

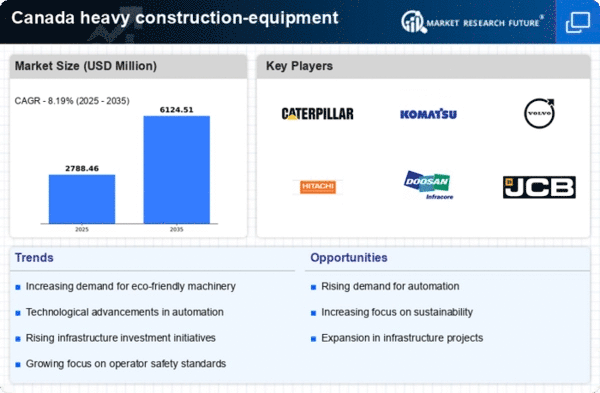

The heavy construction-equipment market in Canada is experiencing a notable surge due to increasing urbanization. As cities expand, the demand for infrastructure development intensifies, necessitating the use of heavy machinery for construction projects. Urban areas are projected to grow, with estimates suggesting that by 2030, over 80% of Canadians will reside in urban settings. This trend drives the need for efficient construction processes, thereby boosting the heavy construction-equipment market. Furthermore, the Canadian government has initiated various urban development projects, which further stimulates the demand for heavy machinery. The market is likely to see a compound annual growth rate (CAGR) of approximately 5% over the next few years, reflecting the growing reliance on heavy construction equipment to meet urban infrastructure needs.

Environmental Regulations

The heavy construction-equipment market in Canada is influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. The Canadian government has implemented various policies that require construction companies to adopt eco-friendly practices. This includes the use of low-emission machinery and adherence to specific environmental standards. As a result, manufacturers are increasingly focusing on producing equipment that meets these regulations, which may lead to a shift in market dynamics. The demand for electric and hybrid construction equipment is expected to rise, potentially accounting for 30% of the market by 2030. This regulatory landscape is likely to drive innovation and investment in cleaner technologies within the heavy construction-equipment market.

Technological Integration

Technological integration within the heavy construction-equipment market is transforming operational efficiencies. The adoption of advanced technologies such as telematics, automation, and artificial intelligence is becoming increasingly prevalent. These innovations enhance equipment performance, reduce downtime, and improve safety standards on construction sites. In Canada, the market is witnessing a shift towards smart machinery, which can communicate data in real-time, allowing for better decision-making. Reports indicate that the integration of technology could lead to a 20% increase in productivity within the sector. As construction companies seek to optimize their operations, the heavy construction-equipment market is likely to benefit from this trend, with investments in technology expected to rise significantly.

Increased Construction Activity

The heavy construction-equipment market in Canada is currently experiencing a surge in construction activity across various sectors, including residential, commercial, and industrial. This uptick is driven by a combination of factors, including low-interest rates and a growing population that fuels housing demand. The residential construction sector alone is projected to grow by 4% annually, leading to increased investments in heavy machinery. Additionally, commercial construction is also on the rise, with several large-scale projects underway. This heightened activity is likely to sustain the demand for heavy construction equipment, as contractors require reliable and efficient machinery to complete projects on time and within budget. The overall outlook for the heavy construction-equipment market remains positive, with expectations of continued growth.

Infrastructure Renewal Projects

Infrastructure renewal projects are a critical driver for the heavy construction-equipment market in Canada. Aging infrastructure, including roads, bridges, and public transit systems, necessitates significant investment and modernization efforts. The Canadian government has allocated substantial funding for infrastructure renewal, with a commitment of over $180 billion over the next decade. This investment is expected to create a robust demand for heavy construction equipment as companies engage in large-scale renovation and rebuilding efforts. The heavy construction-equipment market is poised to benefit from this influx of projects, with projections indicating a steady growth trajectory as contractors seek to upgrade their machinery to meet the demands of these extensive projects.