Increased Focus on Customer Experience

An increased focus on customer experience is emerging as a key driver in the field force-automation market in Canada. Organizations are recognizing that enhancing customer interactions is crucial for retaining clients and gaining a competitive edge. Automation solutions that streamline communication and service delivery are becoming essential tools for businesses aiming to improve customer satisfaction. By automating routine tasks, field personnel can dedicate more time to engaging with customers and addressing their needs effectively. This shift is likely to result in a more responsive service model, thereby driving the growth of the field force-automation market as companies invest in technologies that enhance customer experience.

Rising Demand for Operational Efficiency

The field force-automation market in Canada is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their field operations to reduce costs and enhance productivity. This trend is driven by the competitive landscape, where companies strive to optimize resource allocation and minimize downtime. According to recent data, businesses that implement field force automation solutions can achieve up to a 30% increase in operational efficiency. This growing emphasis on efficiency is likely to propel the field force-automation market forward, as companies seek innovative solutions to improve their service delivery and customer satisfaction.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the field force-automation market in Canada. As industries face stringent regulations regarding safety and operational practices, organizations are turning to automation solutions to ensure compliance and mitigate risks. Field force automation tools can help track compliance metrics and streamline reporting processes, thereby reducing the burden on field personnel. This trend is particularly evident in sectors such as construction and utilities, where adherence to safety regulations is paramount. The need for compliance is likely to drive investments in automation technologies, contributing to the growth of the field force-automation market as companies seek to enhance their operational integrity.

Growing Emphasis on Data-Driven Decision Making

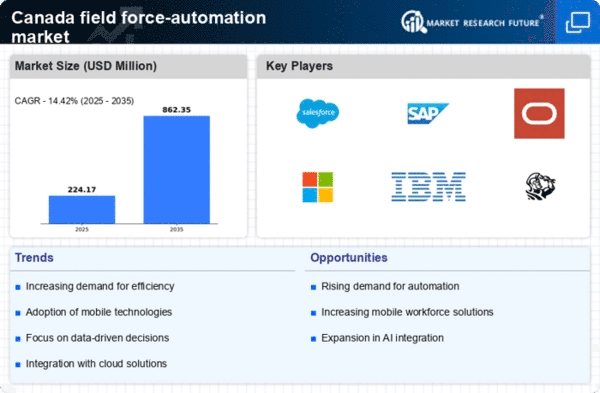

The field force-automation market is witnessing a growing emphasis on data-driven decision making among Canadian enterprises. Organizations are increasingly leveraging data analytics to gain insights into field operations, customer preferences, and market trends. This shift towards data-centric strategies is fostering the adoption of automation tools that facilitate real-time data collection and analysis. Companies that utilize data-driven approaches are likely to experience improved decision-making capabilities, leading to enhanced operational performance. The market is expected to expand as more businesses recognize the value of data in optimizing their field operations, potentially driving growth rates of 20% annually.

Technological Advancements in Mobile Connectivity

Technological advancements in mobile connectivity are significantly influencing the field force-automation market in Canada. The proliferation of 4G and 5G networks has enabled real-time data access and communication for field personnel, enhancing their ability to respond to customer needs promptly. This improved connectivity allows for seamless integration of various field force automation tools, leading to better data collection and analysis. As a result, organizations are increasingly investing in mobile solutions to leverage these advancements. The market is projected to grow as companies adopt mobile technologies to enhance their field operations, potentially increasing market size by 25% over the next few years.