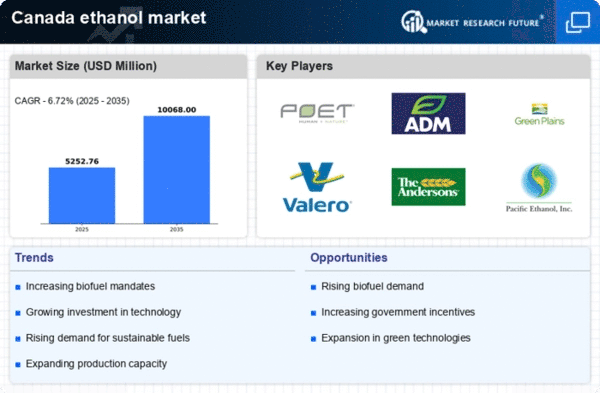

The Canadian ethanol market exhibits a competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for renewable fuels, government mandates promoting biofuels, and advancements in production technologies. Major companies such as POET LLC (US), Archer Daniels Midland Company (US), and Cargill Inc. (US) are strategically positioned to leverage these trends. POET LLC (US) focuses on innovation in production processes, aiming to enhance efficiency and reduce carbon emissions, while Archer Daniels Midland Company (US) emphasizes regional expansion and partnerships to strengthen its supply chain. Cargill Inc. (US) is actively pursuing digital transformation initiatives to optimize operations and improve market responsiveness, collectively shaping a competitive environment that prioritizes sustainability and technological advancement.In terms of business tactics, companies are increasingly localizing manufacturing to reduce transportation costs and enhance supply chain resilience. The market structure appears moderately fragmented, with several key players exerting influence over pricing and production standards. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like Valero Energy Corporation (US) and Green Plains Inc. (US) ensures that competition remains robust and dynamic.

In October Valero Energy Corporation (US) announced a strategic partnership with a leading technology firm to develop advanced biofuel production methods. This collaboration is expected to enhance Valero's production capabilities and align with its sustainability goals, potentially positioning the company as a leader in innovative ethanol solutions. The strategic importance of this partnership lies in its potential to reduce production costs and improve environmental outcomes, thereby appealing to a growing base of environmentally conscious consumers.

In September Green Plains Inc. (US) unveiled a new facility aimed at producing high-protein animal feed alongside ethanol. This dual production strategy not only diversifies Green Plains' revenue streams but also addresses the increasing demand for sustainable animal feed. The significance of this move is underscored by the potential to capture a larger market share in both the ethanol and animal feed sectors, reflecting a strategic pivot towards integrated production models.

In August Cargill Inc. (US) launched a digital platform designed to enhance supply chain transparency and efficiency in ethanol distribution. This initiative is indicative of a broader trend towards digitalization within the industry, as companies seek to leverage technology to streamline operations and improve customer engagement. The strategic importance of this platform lies in its ability to provide real-time data analytics, which can significantly enhance decision-making processes and operational agility.

As of November current competitive trends in the ethanol market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming pivotal in shaping the landscape, as companies collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology adoption, and supply chain reliability. This shift suggests that companies that prioritize sustainable practices and technological advancements will be better positioned to thrive in an increasingly competitive environment.