Expansion of 5G Networks

The rollout of 5G networks is poised to be a transformative driver for the Canada data center market. With the potential for significantly faster data transmission speeds and lower latency, 5G technology is expected to enhance the performance of data centers. In 2025, it was estimated that 5G adoption would increase data traffic by over 50% in urban areas. This surge in data demand necessitates the expansion of data center capabilities to support the growing number of connected devices and applications. Consequently, data centers are likely to invest in infrastructure upgrades to accommodate the anticipated influx of data traffic.

Investment in Renewable Energy

The Canada data center market is increasingly influenced by investments in renewable energy sources. With a commitment to reducing carbon footprints, many data center operators are transitioning to sustainable energy solutions. In 2025, over 60% of data centers in Canada reported utilizing renewable energy sources, such as hydroelectric and wind power. This shift not only aligns with national sustainability goals but also attracts environmentally conscious clients. Furthermore, the Canadian government has introduced incentives for data centers that adopt green technologies, further stimulating investment in renewable energy infrastructure.

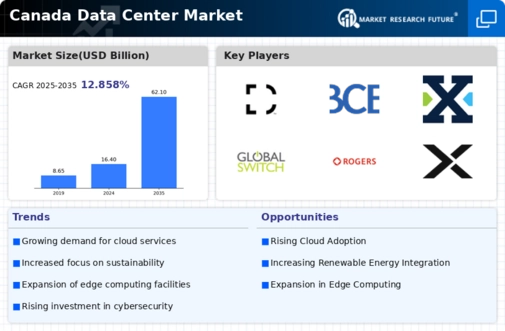

Growing Demand for Cloud Services

The increasing reliance on cloud services is a primary driver for the Canada data center market. As businesses migrate to cloud-based solutions, the demand for data storage and processing capabilities surges. In 2025, the cloud computing market in Canada was valued at approximately CAD 10 billion, reflecting a robust growth trajectory. This trend is expected to continue, with projections indicating a compound annual growth rate of around 15% through 2027. Consequently, data centers are expanding their infrastructure to accommodate this influx of cloud service requirements, thereby enhancing their operational capacities and service offerings.

Technological Advancements in Data Management

Technological innovations play a crucial role in shaping the Canada data center market. The advent of advanced data management solutions, such as artificial intelligence and machine learning, enhances operational efficiency and data processing capabilities. In 2025, approximately 40% of Canadian data centers integrated AI-driven technologies to optimize resource allocation and improve service delivery. This trend is likely to continue, as organizations seek to leverage these technologies to gain a competitive edge. The integration of cutting-edge technologies not only improves performance but also reduces operational costs, making data centers more attractive to potential clients.

Regulatory Framework and Compliance Requirements

The regulatory landscape significantly impacts the Canada data center market. With increasing concerns over data privacy and security, compliance with regulations such as the Personal Information Protection and Electronic Documents Act (PIPEDA) is paramount. In 2025, nearly 75% of data centers in Canada reported implementing measures to ensure compliance with these regulations. This focus on regulatory adherence not only protects consumer data but also enhances the credibility of data center operators. As regulations evolve, data centers must continuously adapt their practices to meet compliance requirements, thereby driving investment in security and infrastructure.