Focus on Cost Reduction Strategies

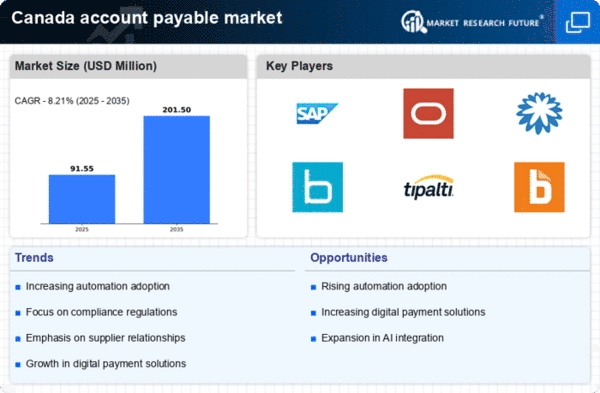

In the current economic climate, Canadian businesses are increasingly prioritizing cost reduction strategies, which directly impacts the account payable market. Organizations are seeking ways to minimize expenses associated with invoice processing and payment approvals. A recent survey indicated that nearly 45% of companies are exploring automation to reduce labor costs and improve processing times. This focus on cost efficiency is driving the adoption of advanced technologies, such as robotic process automation (RPA), within the account payable market. By streamlining workflows and reducing manual intervention, businesses can achieve significant savings, which is likely to propel further investment in automation solutions.

Increasing Demand for Digital Solutions

The account payable market in Canada is shifting towards digital solutions to enhance efficiency and accuracy in financial processes. Businesses are increasingly adopting cloud-based platforms to streamline their accounts payable operations. According to recent data, approximately 60% of Canadian companies have implemented some form of digital invoicing, which enhances processing speed and reduces errors. This trend indicates a growing reliance on technology to manage financial transactions, thereby transforming the account payable market. As organizations seek to optimize cash flow and reduce operational costs, the demand for integrated digital solutions is likely to continue rising, further shaping the landscape of the account payable market.

Emergence of Real-Time Payment Solutions

The market is on the brink of transformation with the emergence of real-time payment solutions. As businesses seek to enhance their payment processes, the demand for instant payment capabilities is growing. Recent data suggests that approximately 30% of Canadian companies are exploring real-time payment options to improve cash flow management and supplier satisfaction. This shift towards immediacy in payments is likely to reshape the account payable market, as organizations adopt technologies that facilitate faster transactions. The integration of real-time payment solutions could lead to a more dynamic financial ecosystem, where businesses can respond swiftly to market changes and supplier needs.

Regulatory Changes and Compliance Requirements

The account payable market in Canada is significantly influenced by evolving regulatory frameworks and compliance requirements. Recent legislative changes have necessitated that businesses adopt more stringent financial practices, particularly concerning tax compliance and reporting. For instance, the introduction of the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) has compelled companies to enhance their accounts payable processes to ensure accurate tax reporting. This compliance-driven approach is expected to increase the demand for specialized software solutions that can automate compliance checks and reporting. Consequently, the account payable market is likely to see a surge in the adoption of tools designed to meet these regulatory demands, thereby enhancing operational efficiency.

Shift Towards Supplier Relationship Management

The market is witnessing a shift towards enhanced supplier relationship management (SRM) practices. Companies are recognizing the importance of maintaining strong relationships with suppliers to ensure favorable payment terms and conditions. This trend is reflected in the increasing investment in SRM tools that facilitate better communication and collaboration with suppliers. By fostering these relationships, businesses can negotiate better pricing and payment terms, ultimately impacting their cash flow positively. As organizations continue to prioritize supplier engagement, the account payable market is expected to evolve, with a greater emphasis on tools that support effective SRM strategies.