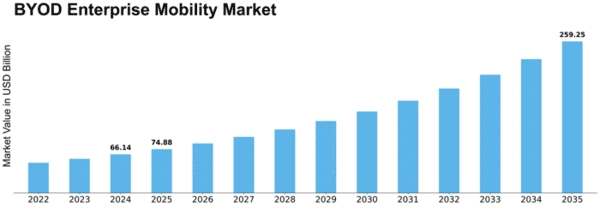

Byod Enterprise Mobility Size

BYOD Enterprise Mobility Market Growth Projections and Opportunities

The market dynamics of the BYOD (Bring Your Own Device) and Enterprise Mobility market are influenced by a multitude of factors driving the adoption and evolution of policies, technologies, and solutions aimed at enabling employees to use personal devices for work-related tasks. At its core, BYOD and Enterprise Mobility refer to the practice of allowing employees to use their smartphones, tablets, laptops, and other personal devices to access corporate data and applications, collaborate with colleagues, and perform work tasks from anywhere, at any time. One of the primary drivers fueling the growth of the BYOD and Enterprise Mobility market is the increasing demand for flexibility and productivity in the modern workplace. With the rise of remote work, flexible work arrangements, and the gig economy, employees expect to have the freedom to choose the devices and tools that best suit their work styles and preferences. BYOD and Enterprise Mobility solutions empower employees to work more efficiently and effectively by providing seamless access to corporate resources and enabling collaboration and communication on the go.

Moreover, the proliferation of mobile devices and the ubiquity of high-speed internet connectivity are driving adoption of BYOD and Enterprise Mobility solutions. As smartphones and tablets become more powerful and affordable, and as wireless networks continue to improve in speed and reliability, employees are increasingly relying on mobile devices as their primary computing platforms for both personal and professional tasks. BYOD and Enterprise Mobility solutions leverage the capabilities of mobile devices to deliver a seamless and intuitive user experience, enabling employees to access email, documents, enterprise applications, and other corporate resources from their smartphones and tablets, regardless of their location.

Additionally, the growing emphasis on cost savings and operational efficiency is driving organizations to embrace BYOD and Enterprise Mobility initiatives. By allowing employees to use their own devices for work, organizations can reduce the need to purchase and provision company-owned devices, saving on hardware costs and IT support overhead. Moreover, BYOD and Enterprise Mobility solutions enable organizations to streamline IT management processes, simplify device provisioning and enrollment, and enhance security and compliance through centralized management and enforcement of policies such as device encryption, remote wipe, and access control. As organizations seek to optimize their IT investments and improve agility and responsiveness to business needs, BYOD and Enterprise Mobility solutions offer a compelling value proposition for cost-conscious enterprises.

Furthermore, the COVID-19 pandemic has accelerated the adoption of BYOD and Enterprise Mobility solutions as organizations shift to remote work and digital-first business models. With the sudden transition to remote work, employees have become more reliant on their personal devices to stay connected, collaborate with colleagues, and access corporate resources from home. BYOD and Enterprise Mobility solutions have played a critical role in enabling remote work by providing secure access to corporate networks, applications, and data from any device and location. As organizations adapt to the new normal of remote work and hybrid work environments, the demand for flexible and scalable BYOD and Enterprise Mobility solutions is expected to continue growing.

Moreover, the increasing focus on employee experience and satisfaction is driving adoption of BYOD and Enterprise Mobility initiatives. By allowing employees to use their preferred devices for work, organizations can empower them to be more productive, creative, and engaged in their roles. Employees appreciate the flexibility and convenience of using familiar devices and applications for work-related tasks, which can lead to higher job satisfaction, morale, and retention rates. Additionally, BYOD and Enterprise Mobility solutions enable organizations to attract top talent, particularly among younger generations who prioritize flexibility, autonomy, and work-life balance in their career decisions. As organizations compete for talent in a tight labor market, offering BYOD and Enterprise Mobility programs can be a strategic differentiator to attract and retain skilled employees.

However, the BYOD and Enterprise Mobility market also faces several challenges that could impact its growth trajectory. One such challenge is security and compliance concerns associated with the use of personal devices for work-related tasks. Personal devices may lack the security features and controls of company-owned devices, posing risks such as data breaches, malware infections, and unauthorized access to corporate networks and data. Organizations must implement robust security measures, such as mobile device management (MDM), mobile application management (MAM), and containerization, to mitigate these risks and ensure compliance with regulatory requirements such as GDPR and HIPAA.

Furthermore, the complexity of managing a diverse and heterogeneous device landscape presents challenges for IT teams tasked with supporting BYOD and Enterprise Mobility initiatives. Unlike company-owned devices, which can be centrally managed and standardized, personal devices come in various makes, models, operating systems, and configurations, making it challenging to enforce uniform policies and security controls across the entire device fleet. Moreover, BYOD and Enterprise Mobility solutions must integrate seamlessly with existing IT systems and applications, such as email, collaboration platforms, and enterprise resource planning (ERP) systems, to ensure a seamless user experience and maximize productivity. Organizations must invest in training, tools, and processes to effectively manage and support BYOD and Enterprise Mobility deployments and address the complexities of a mobile-first workforce.

Leave a Comment