Market Share

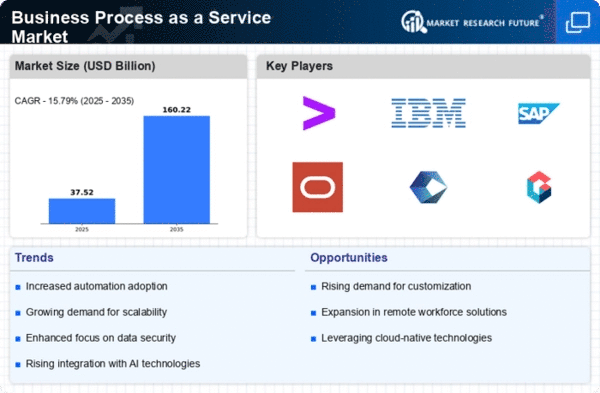

Business Process as a Service Market Share Analysis

Businesses may use a variety of market share positioning tactics in the diversified environment provided by the business process as a service (BPaaS) market. Product differentiation is a popular strategy, with businesses highlighting the unique qualities and advantages of their BPaaS offerings. This might include emphasizing improved automation capabilities, simplified corporate procedures, or market-specific knowledge. Businesses want to make a name for themselves in the market and draw in customers who are searching for certain enhancements to their company processes by exhibiting these differentiators. Another important tactic is cost leadership, in which businesses concentrate on providing BPaaS products at a competitive cost. Offering affordable but effective business process solutions may help enterprises acquire market share and appeal to budget-conscious businesses. Another important factor is market segmentation, wherein businesses identify and target certain business sectors or industries with specialized BPaaS products. Businesses may place their goods to solve certain business difficulties and increase their market share inside niches by knowing the particular demands of various market groups. The BPaaS market is driven by innovation, as businesses are always looking to integrate state-of-the-art analytics, integration, and process automation capabilities. Companies may draw in tech-savvy clients and build a strong brand by keeping ahead of the curve and providing cutting-edge solutions. Alliances and partnerships are also crucial, as businesses work together with other technology suppliers, advisory services, or sector specialists to increase their market share. Companies may increase their market share and impact by partnering with complementary services and building strategic alliances that capitalize on each other's advantages. In the BPaaS market, market share positioning may be significantly impacted by Customer Experience and Support, two important elements. Businesses may draw and keep a wider clientele by emphasizing user-friendly interfaces, smooth deployment procedures, and attentive customer support, which will eventually boost their position in the BPaaS market. Businesses may expand their market share by fostering enduring connections and customer loyalty via the provision of excellent customer experiences. The positioning of market share is also significantly shaped by marketing and communication initiatives. Businesses take part in thought leadership material, targeted advertising, market events, and aggressive marketing and promotional campaigns. The objectives of these endeavors are to elevate awareness, cultivate brand identity, and forge a robust foothold within the BPaaS market. Through proficient communication of the benefits of their BPaaS solutions to the intended audience, businesses may impact procurement choices and get a competitive advantage.

Leave a Comment