Rising Demand for Electric Buses

The increasing demand for electric buses is a significant driver for the Bus Pantograph Charger Market. As urban areas seek to reduce air pollution and greenhouse gas emissions, electric buses are becoming a preferred choice for public transportation. This shift is supported by various studies indicating that electric buses can reduce emissions by up to 70% compared to their diesel counterparts. Consequently, the need for efficient charging solutions, such as pantograph chargers, is expected to grow. Market analysts suggest that the expansion of electric bus fleets will create a robust demand for charging infrastructure, potentially leading to a market size exceeding several billion dollars by the end of the decade.

Government Initiatives and Funding

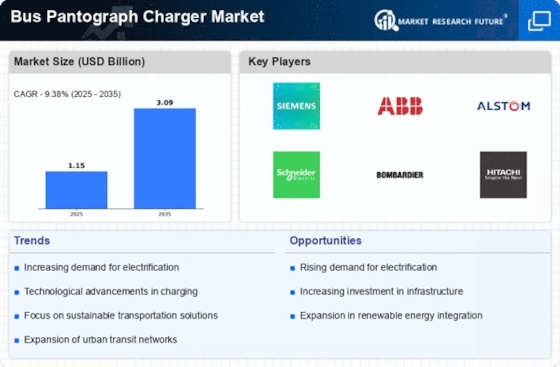

Government initiatives play a pivotal role in shaping the Bus Pantograph Charger Market. Various countries are implementing policies that promote the adoption of electric buses, which in turn drives the need for efficient charging solutions. For instance, funding programs aimed at enhancing public transport electrification have been established, with some regions allocating millions in subsidies for infrastructure development. This financial support not only encourages transit authorities to invest in pantograph charging systems but also fosters partnerships between public and private sectors. As a result, the market is likely to witness accelerated growth, with projections indicating a compound annual growth rate of over 15% in the coming years.

Urbanization and Public Transport Expansion

Urbanization is a critical factor driving the Bus Pantograph Charger Market. As cities expand and populations grow, the demand for efficient public transport systems intensifies. Electric buses are increasingly viewed as a viable solution to meet this demand, given their lower operational costs and environmental benefits. The expansion of public transport networks often necessitates the establishment of robust charging infrastructure, including pantograph chargers. Data indicates that urban areas with high population density are likely to invest heavily in electric bus fleets, thereby creating a substantial market for charging solutions. This trend suggests that the Bus Pantograph Charger Market will continue to thrive as urbanization progresses.

Focus on Sustainability and Environmental Regulations

The Bus Pantograph Charger Market is significantly influenced by the global focus on sustainability and stringent environmental regulations. Governments are increasingly mandating the reduction of carbon footprints, which has led to a surge in the adoption of electric vehicles, including buses. This regulatory environment encourages transit agencies to transition to cleaner technologies, thereby increasing the demand for pantograph charging systems. Recent reports indicate that regions with strict emissions standards are likely to see a higher penetration of electric buses, which in turn necessitates the development of efficient charging infrastructure. The alignment of market growth with sustainability goals suggests a promising future for the Bus Pantograph Charger Market.

Technological Advancements in Charging Infrastructure

The Bus Pantograph Charger Market is experiencing a surge in technological advancements that enhance the efficiency and reliability of electric bus charging systems. Innovations such as automated pantograph systems and smart grid integration are becoming increasingly prevalent. These technologies not only streamline the charging process but also optimize energy consumption, which is crucial for fleet operators. According to recent data, the implementation of advanced charging solutions can reduce operational costs by up to 20%. As cities invest in modernizing their public transport infrastructure, the demand for sophisticated charging solutions is likely to rise, further propelling the Bus Pantograph Charger Market.