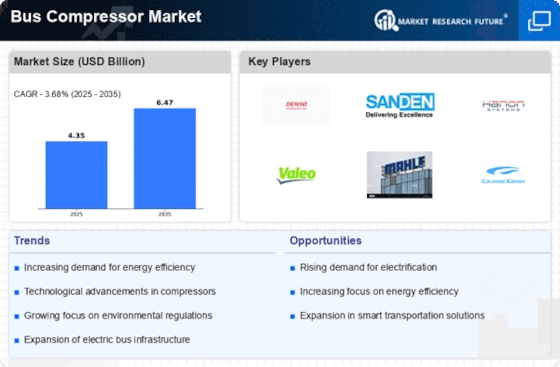

Growth of Electric and Hybrid Buses

The shift towards electric and hybrid buses is reshaping the Bus Compressor Market. As manufacturers pivot to produce more environmentally friendly vehicles, the demand for specialized compressors that cater to electric and hybrid systems is on the rise. These compressors are designed to support the unique requirements of electric drivetrains, ensuring optimal performance and energy efficiency. Market analysis reveals that the electric bus segment is expected to grow at a staggering rate of 25% annually, driven by both consumer preference and government incentives. This transition not only presents challenges but also opportunities for compressor manufacturers to innovate and adapt their products to meet the evolving needs of the market.

Rising Demand for Public Transportation

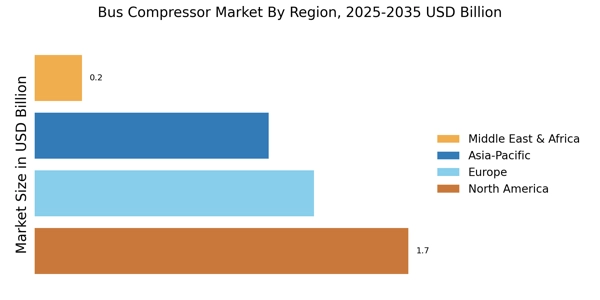

The increasing urban population has led to a heightened demand for efficient public transportation systems. As cities expand, the need for reliable and sustainable transport solutions becomes paramount. This trend is particularly evident in densely populated areas where traffic congestion is prevalent. The Bus Compressor Market is poised to benefit from this demand, as buses equipped with advanced compressors enhance fuel efficiency and reduce emissions. According to recent data, the bus market is projected to grow at a compound annual growth rate of 4.5% over the next five years, indicating a robust opportunity for compressor manufacturers. The integration of eco-friendly technologies in bus design further propels the need for high-performance compressors, making this driver a critical factor in the industry's growth.

Technological Innovations in Compressor Design

Technological advancements in compressor design are transforming the Bus Compressor Market. Innovations such as variable speed compressors and energy-efficient models are gaining traction, allowing for improved performance and reduced operational costs. These advancements not only enhance the reliability of bus systems but also contribute to lower emissions, aligning with global sustainability goals. The introduction of smart technology in compressors, which allows for real-time monitoring and predictive maintenance, is also noteworthy. This trend is expected to drive the market forward, as operators seek to optimize their fleets. Market data suggests that the adoption of advanced compressor technologies could lead to a 20% reduction in energy consumption, making it a pivotal driver in the Bus Compressor Market.

Government Regulations and Environmental Standards

Government regulations aimed at reducing carbon emissions and promoting sustainable practices are significantly influencing the Bus Compressor Market. Stricter environmental standards compel manufacturers to innovate and develop compressors that meet these requirements. As cities implement policies to phase out older, less efficient buses, the demand for modern, compliant compressors is likely to surge. This regulatory landscape not only drives technological advancements but also encourages investment in cleaner technologies. Recent statistics indicate that regions enforcing stringent emissions regulations have seen a 15% increase in the adoption of eco-friendly bus systems, thereby creating a favorable environment for the Bus Compressor Market to thrive.

Increased Investment in Infrastructure Development

Investment in public transportation infrastructure is a crucial driver for the Bus Compressor Market. Governments and private entities are allocating substantial funds to enhance transit systems, which includes upgrading bus fleets with modern compressors. This investment is often aimed at improving service quality and reducing operational costs. Recent reports indicate that infrastructure spending in the transportation sector is projected to increase by 10% over the next few years, creating a favorable environment for the Bus Compressor Market. As new bus depots and maintenance facilities are established, the demand for advanced compressor systems is likely to rise, further propelling market growth.