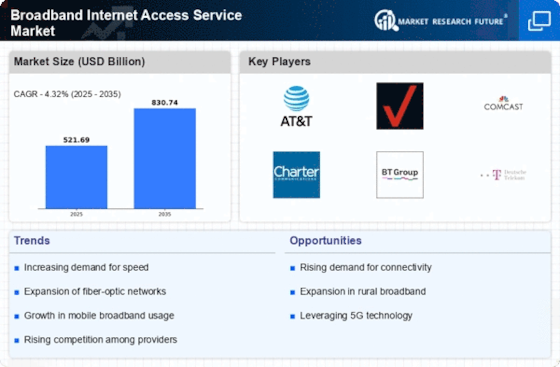

Rising Digital Transformation

The ongoing digital transformation across various sectors appears to be a primary driver for the Broadband Internet Access Service Market. Businesses and consumers increasingly rely on high-speed internet for daily operations, communication, and entertainment. As organizations adopt cloud computing, big data analytics, and IoT technologies, the demand for robust broadband services intensifies. According to recent data, the number of internet users has surged, with estimates indicating that over 4.9 billion people are now online. This trend suggests that the Broadband Internet Access Service Market must adapt to meet the growing needs of both residential and commercial users, potentially leading to increased investments in infrastructure and service enhancements.

Increased Remote Work and Learning

The shift towards remote work and online learning has significantly influenced the Broadband Internet Access Service Market. As more companies adopt flexible work arrangements, the demand for reliable and high-speed internet has surged. Educational institutions have also transitioned to online platforms, necessitating robust broadband services for students and educators. Recent statistics suggest that approximately 30% of the workforce is now engaged in remote work, highlighting the critical need for enhanced internet connectivity. This trend indicates that the Broadband Internet Access Service Market must evolve to accommodate the growing reliance on digital communication and learning tools.

Government Initiatives and Policies

Government initiatives aimed at enhancing broadband access are likely to play a crucial role in shaping the Broadband Internet Access Service Market. Various countries have implemented policies to promote digital inclusion, particularly in underserved areas. For instance, funding programs and subsidies for broadband expansion have been introduced to ensure equitable access to high-speed internet. Data indicates that nations investing in broadband infrastructure have witnessed significant improvements in connectivity rates. This governmental support not only stimulates market growth but also encourages private sector participation, fostering a competitive environment that benefits consumers and businesses alike.

Growing Demand for Streaming Services

The rising popularity of streaming services is a significant driver for the Broadband Internet Access Service Market. As consumers increasingly turn to platforms for entertainment, the demand for high-speed internet has escalated. Reports indicate that streaming services have seen a substantial increase in subscribers, with millions of users accessing content daily. This trend necessitates robust broadband connections capable of supporting high-definition video streaming without interruptions. Consequently, service providers are compelled to enhance their offerings to meet consumer expectations, thereby propelling growth within the Broadband Internet Access Service Market.

Technological Advancements in Broadband Solutions

Technological advancements in broadband solutions are driving innovation within the Broadband Internet Access Service Market. The emergence of fiber-optic technology, satellite internet, and fixed wireless access has expanded the range of options available to consumers. These advancements not only improve internet speeds but also enhance reliability and coverage. Data shows that fiber-optic connections can deliver speeds exceeding 1 Gbps, which is becoming increasingly essential for modern applications. As technology continues to evolve, service providers are likely to invest in upgrading their infrastructure, thereby fostering competition and improving service quality in the Broadband Internet Access Service Market.