Advancements in Satellite Technology

Technological advancements in satellite systems are transforming the Commercial Satellite Broadband Market. Innovations such as high-throughput satellites (HTS) and low Earth orbit (LEO) constellations are enhancing bandwidth capacity and reducing latency. These advancements enable service providers to offer faster and more reliable internet services, which are crucial for meeting the demands of modern users. The introduction of HTS has reportedly increased throughput by up to five times compared to traditional satellites, making satellite broadband a more competitive option. As technology continues to evolve, the Commercial Satellite Broadband Market is expected to expand, attracting new players and increasing competition.

Growing Adoption of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices and smart technologies is driving the demand for robust internet connectivity. The Commercial Satellite Broadband Market is well-positioned to cater to this need, as satellite networks can provide coverage in remote locations where terrestrial networks may not reach. With millions of IoT devices expected to be connected in the coming years, the requirement for reliable and high-speed internet is paramount. This trend suggests that satellite broadband will play a crucial role in supporting the infrastructure needed for IoT applications, thereby contributing to the growth of the Commercial Satellite Broadband Market.

Regulatory Support for Satellite Services

Regulatory frameworks are evolving to support the growth of satellite broadband services. Governments are increasingly recognizing the importance of satellite connectivity in bridging the digital divide and are implementing policies that facilitate the deployment of satellite networks. The Commercial Satellite Broadband Market stands to benefit from these supportive regulations, which may include streamlined licensing processes and incentives for investment. As regulatory environments become more favorable, the barriers to entry for new market participants may decrease, fostering competition and innovation. This regulatory support is likely to enhance the overall landscape of the Commercial Satellite Broadband Market.

Increased Demand for High-Speed Internet Access

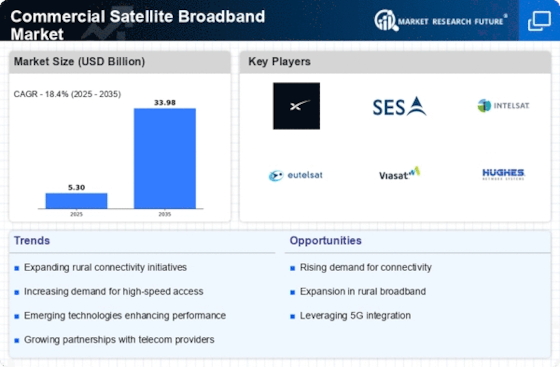

The demand for high-speed internet access continues to rise, particularly in underserved and remote areas. This trend is driven by the increasing reliance on digital services for education, healthcare, and business operations. The Commercial Satellite Broadband Market is poised to benefit from this demand, as satellite technology offers a viable solution for providing connectivity where traditional infrastructure is lacking. According to recent data, the number of satellite broadband subscribers has been steadily increasing, indicating a growing acceptance of satellite solutions. As more consumers and businesses seek reliable internet access, the Commercial Satellite Broadband Market is likely to experience significant growth, driven by the need for enhanced connectivity.

Increased Investment in Satellite Infrastructure

Investment in satellite infrastructure is on the rise, as both private and public sectors recognize the potential of satellite broadband. Governments and private companies are allocating substantial resources to develop and enhance satellite networks, which is likely to bolster the Commercial Satellite Broadband Market. For instance, several countries are investing in satellite constellations to improve national connectivity and support economic development. This influx of capital is expected to accelerate the deployment of satellite broadband services, making them more accessible to a wider audience. As infrastructure improves, the Commercial Satellite Broadband Market may witness a surge in user adoption and service offerings.