Rising Adoption of Smart Devices

The rising adoption of smart devices is another key driver of the Broadband Access Equipment Market. As households and businesses increasingly integrate smart technologies, the demand for robust broadband connectivity has intensified. Smart home devices, IoT applications, and connected appliances require reliable internet access to function optimally. Recent statistics indicate that the number of connected devices is projected to reach over 30 billion by 2025, further emphasizing the need for enhanced broadband infrastructure. This trend compels service providers to invest in advanced broadband access equipment to support the growing ecosystem of smart devices, thereby fostering market expansion.

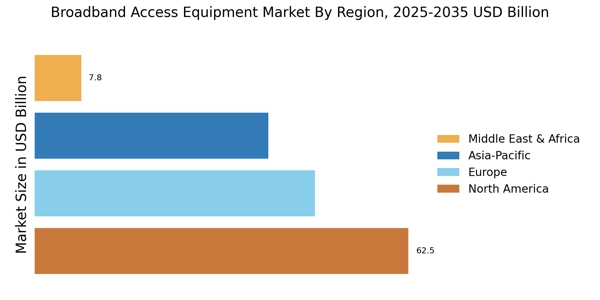

Government Initiatives and Funding

Government initiatives aimed at expanding broadband access play a crucial role in driving the Broadband Access Equipment Market. Various countries have launched programs to enhance internet connectivity, particularly in underserved and rural areas. For instance, funding allocations for broadband infrastructure projects have increased significantly, with billions of dollars earmarked for development. These initiatives not only aim to bridge the digital divide but also stimulate economic growth by enabling businesses and communities to access essential online services. As a result, the demand for broadband access equipment is likely to rise, as service providers seek to comply with regulatory requirements and capitalize on available funding opportunities.

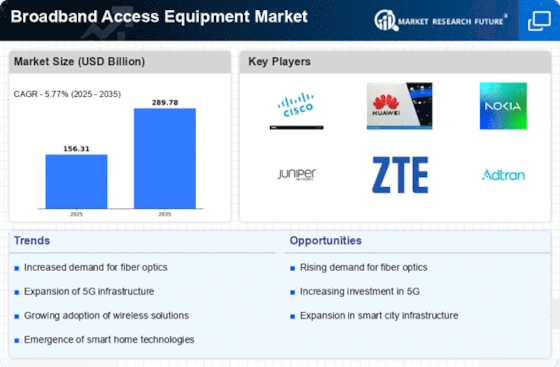

Growing Demand for High-Speed Internet

The increasing demand for high-speed internet access is a primary driver of the Broadband Access Equipment Market. As more consumers and businesses rely on fast and reliable internet for daily operations, the need for advanced broadband access equipment has surged. According to recent data, the number of broadband subscriptions has reached over 1.5 billion worldwide, indicating a robust growth trajectory. This demand is further fueled by the proliferation of data-intensive applications such as streaming services, online gaming, and remote work solutions. Consequently, service providers are investing heavily in upgrading their infrastructure to meet these expectations, thereby propelling the Broadband Access Equipment Market forward.

Technological Advancements in Equipment

Technological advancements in broadband access equipment are significantly influencing the Broadband Access Equipment Market. Innovations such as next-generation fiber optics, advanced wireless technologies, and improved network management solutions are enhancing the performance and efficiency of broadband services. For example, the introduction of 5G technology is expected to revolutionize wireless broadband access, offering higher speeds and lower latency. This shift towards more sophisticated equipment is prompting service providers to upgrade their existing infrastructure, thereby driving market growth. As technology continues to evolve, the demand for cutting-edge broadband access equipment is anticipated to increase, reflecting the industry's dynamic nature.

Increased Competition Among Service Providers

Increased competition among service providers is a significant factor propelling the Broadband Access Equipment Market. As more companies enter the broadband market, there is a heightened focus on delivering superior services and customer experiences. This competitive landscape encourages providers to invest in state-of-the-art broadband access equipment to differentiate themselves from their rivals. Moreover, the emergence of alternative service models, such as fixed wireless access and satellite broadband, is further intensifying competition. As a result, service providers are compelled to enhance their infrastructure and offerings, driving demand for advanced broadband access equipment and contributing to the overall growth of the market.