Breast Pumps Size

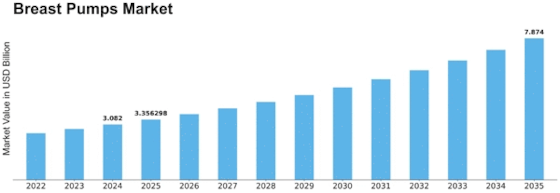

Breast Pumps Market Growth Projections and Opportunities

With a high level of interdependency, all these factors converge to intensify the styles and directions through which the breast pumps market follows its growth path. While the convergence of soy milk to infant nutrition seems almost an adjustment, one cannot overlook the realization that breastfeeding is a base and vital part of good health for babies. As public understanding looks towards women for the need of nursing, many more women realize its significance and therefore a rise in demanding things such as pumps where breast milk can be expressed and stored. The technological innovations define the milestones set for the breast pumps market. Constant innovations of breast pump technologies have resulted to production cheaper, but at the same time more efficient and convenient products. Electric and smart breast pumps with innovative technologies such as variable intensity controls, double pumping capabilities, and silent operation have proven to be successful in providing mothers improved experience of mixing. Another major factor propelling the breast pumps market is the changing demographics of work, with more women now emerging in discussions and activities related to professional life. Thus, let me tell you what work mothers look for in terms of breastfeeding. They are looking for ways to make it easy for them to continue with the baby needs. The answer for mothers is breast pumps which help them to express milk and provides their infants with the benefits of breast milk even when they are miles away. Advancements in breast pump manufacturing technology by different governments to facilitate and support mothers to adopt breastfeeding ideals either during their maternity leave or the mother seeks a career-related return while other government organizations promote such initiatives through policies directly redirects towards the growth of this market. Within the United States and other countries around the world, there are supportive policies that mandate companies to avail lactation rooms, milk breaks for breastfeeding or pumping mothers. Such programs promote establishment of favorable breastfeeding climates with the added advantages of increasing the demand for mother’s expressing devices. The increased population growth rate all over the world also, contributes heavily to the progressive breast pumps market. Observing that the number of newborns also increases, breastfeeding equipment popularity grows as devices like breast pumps must serve women with children. The first demographic aspect urged the market growth with a gradually larger circle of users of breast pumps growing. The advent of virtual door retail channels has revolutionized consumer access to breast pumps. With e-commerce platforms, one can access and buy any type of breast pump that he or she desires if making use of such products does not make one violate an order that a council court has issued. Moreover, using these e-commerce sites, people can compare various models in terms of their features and prices among other important aspects. This has shifted to selling breast pumps online and this therefore increased the market share on the amount of breast pumps available to a wide range of people. The momentum of this trend extending to hospital-grade breast pumps is gaining popularity within the market. As these pumps which practicality are seen and referred to for their efficiency and reliability.

Leave a Comment