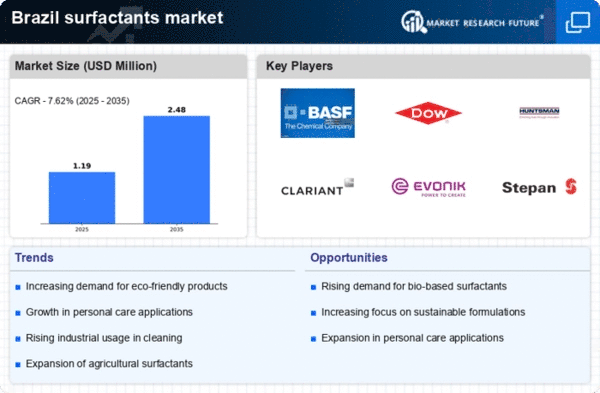

Brazil Surfactants Market Summary

As per Market Research Future analysis, the Brazil surfactants market Size was estimated at 1.11 USD Million in 2024. The Brazil surfactants market is projected to grow from 1.19 USD Million in 2025 to 2.48 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Brazil surfactants market is experiencing a notable shift towards sustainability and innovation.

- The market is witnessing a significant shift towards bio-based surfactants, driven by increasing consumer awareness of environmental issues.

- E-commerce is rapidly expanding, enhancing market accessibility and changing consumer purchasing behaviors in the surfactants sector.

- The personal care segment remains the largest, while the household cleaning segment is emerging as the fastest-growing in Brazil.

- Key market drivers include rising demand in personal care products and sustainability initiatives promoting eco-friendly solutions.

Market Size & Forecast

| 2024 Market Size | 1.11 (USD Million) |

| 2035 Market Size | 2.48 (USD Million) |

| CAGR (2025 - 2035) | 7.62% |

Major Players

BASF SE (DE), Dow Inc. (US), Huntsman Corporation (US), Clariant AG (CH), Evonik Industries AG (DE), Stepan Company (US), Solvay SA (BE), Croda International Plc (GB), AkzoNobel N.V. (NL)