Rising Focus on Cost Efficiency

Cost efficiency remains a critical driver for the software as-a-service market in Brazil. Organizations are increasingly recognizing the financial advantages of SaaS solutions, which typically operate on a subscription model. This model allows businesses to convert capital expenditures into operational expenditures, thereby improving cash flow management. In 2025, it is projected that around 60% of Brazilian enterprises will prioritize SaaS solutions to optimize their IT budgets. The software as-a-service market is likely to thrive as companies seek to minimize costs while maximizing functionality and scalability. This trend indicates a shift towards more agile business practices, where organizations can adapt their software usage based on evolving needs.

Emergence of Niche SaaS Solutions

The software as-a-service market in Brazil is witnessing the emergence of niche SaaS solutions tailored to specific industry needs. As businesses seek specialized tools to address unique challenges, providers are developing targeted applications that cater to sectors such as healthcare, finance, and education. This trend is expected to drive growth in the software as-a-service market, as companies increasingly turn to customized solutions that enhance operational efficiency. In 2025, it is projected that niche SaaS offerings will account for approximately 30% of the overall market, reflecting a shift towards more personalized software solutions that align with industry-specific requirements.

Growing Demand for Remote Work Solutions

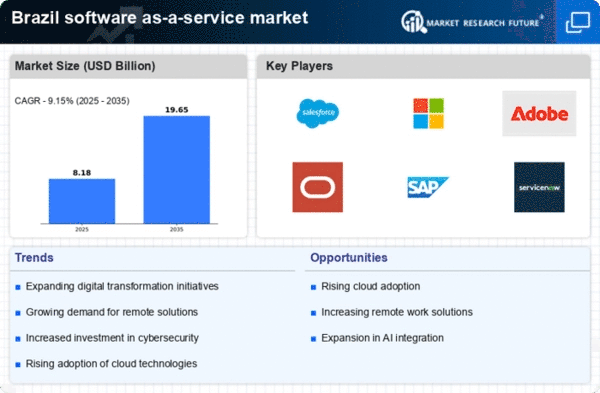

The software as-a-service market in Brazil experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for cloud-based collaboration tools becomes paramount. In 2025, it is estimated that approximately 70% of Brazilian companies will implement remote work policies, driving the adoption of SaaS applications. This shift not only enhances productivity but also reduces operational costs, as businesses can scale their software needs without significant upfront investments. The software as-a-service market is thus positioned to benefit from this trend, as companies seek to leverage technology to facilitate seamless communication and project management among distributed teams.

Increased Investment in Digital Transformation

Brazilian companies are significantly investing in digital transformation initiatives, which serve as a catalyst for the software as-a-service market. As businesses strive to enhance their operational efficiency and customer engagement, the adoption of SaaS solutions becomes increasingly attractive. In 2025, it is anticipated that investments in digital transformation will reach approximately $15 billion in Brazil, with a substantial portion allocated to SaaS applications. This trend suggests that the software as-a-service market will continue to expand, as organizations seek innovative solutions to streamline processes and improve service delivery. The integration of SaaS into digital strategies is likely to redefine competitive landscapes across various sectors.

Growing Emphasis on Data Analytics and Insights

The software as-a-service market in Brazil is increasingly characterized by a growing emphasis on data analytics and insights. Organizations are recognizing the value of data-driven decision-making, prompting a surge in demand for SaaS applications that offer advanced analytics capabilities. In 2025, it is estimated that around 50% of Brazilian companies will integrate data analytics tools into their operations, enhancing their ability to derive actionable insights. This trend indicates that the software as-a-service market is evolving to meet the needs of businesses seeking to leverage data for competitive advantage. As companies prioritize analytics, the demand for SaaS solutions that facilitate data collection, analysis, and visualization is likely to rise.