Rising Cyber Threats

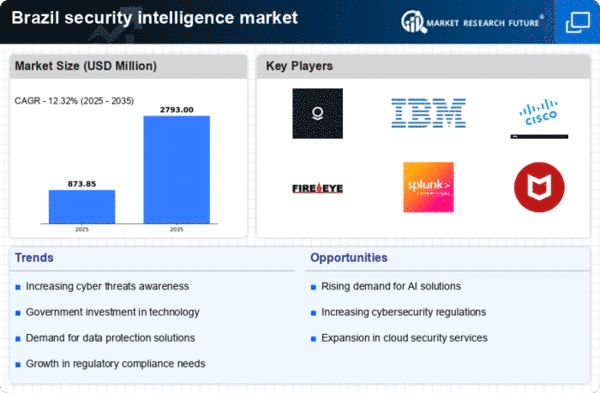

The increasing frequency and sophistication of cyber threats in Brazil is a primary driver for the security intelligence market. Organizations across various sectors are facing heightened risks from cybercriminals, leading to a surge in demand for advanced security solutions. In 2025, it is estimated that cybercrime could cost the Brazilian economy over $20 billion annually, prompting businesses to invest in security intelligence systems. This market is expected to grow at a CAGR of 12% as companies seek to protect sensitive data and maintain operational integrity. The security intelligence market is thus positioned to benefit from this urgent need for enhanced cybersecurity measures.

Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in Brazil is creating new vulnerabilities that the security intelligence market must address. As more devices become interconnected, the potential attack surface for cyber threats expands, necessitating advanced security measures. It is estimated that by 2026, there will be over 1 billion IoT devices in Brazil, each requiring tailored security solutions. This surge presents a substantial opportunity for the security intelligence market to innovate and provide comprehensive security frameworks that can effectively manage the risks associated with IoT deployments.

Increased Data Privacy Concerns

Growing concerns regarding data privacy and protection are propelling the security intelligence market in Brazil. With the implementation of the General Data Protection Law (LGPD), organizations are now required to adopt stringent measures to protect personal data. This regulatory framework has led to a heightened awareness of the importance of security intelligence solutions. Companies are investing in technologies that ensure compliance with data protection regulations, which is expected to drive market growth by approximately 15% over the next few years. The security intelligence market is thus adapting to meet the evolving demands for data security and privacy.

Adoption of Cloud-Based Solutions

The shift towards cloud computing is reshaping the security intelligence market in Brazil. As businesses increasingly migrate their operations to the cloud, the need for robust security measures to protect cloud-based data becomes paramount. The cloud security market is projected to grow by 20% annually, reflecting the rising demand for integrated security intelligence solutions that can operate effectively in cloud environments. This trend indicates a significant opportunity for the security intelligence market to develop innovative solutions that address the unique challenges posed by cloud security.

Government Initiatives and Funding

Brazilian government initiatives aimed at bolstering national security are significantly influencing the security intelligence market. The government has allocated substantial funding to enhance cybersecurity infrastructure, with investments projected to reach $1 billion by 2026. These initiatives include the establishment of national cybersecurity strategies and partnerships with private sectors to improve threat detection and response capabilities. As a result, the security intelligence market is likely to experience accelerated growth, driven by public sector demand for innovative security solutions that can safeguard critical infrastructure and sensitive information.