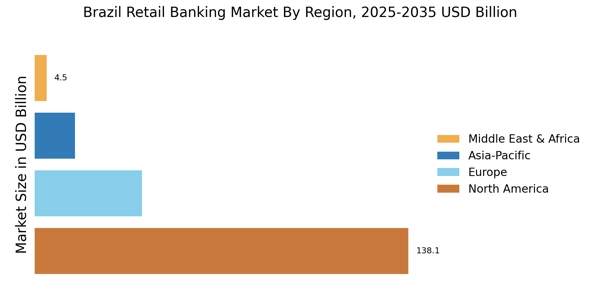

North America : Stable Financial Environment

The North American retail banking market is characterized by a stable financial environment, driven by strong regulatory frameworks and technological advancements. The U.S. holds the largest market share at approximately 70%, followed by Canada at around 15%. The demand for digital banking solutions is surging, fueled by consumer preferences for convenience and efficiency. Regulatory catalysts, such as the Dodd-Frank Act, continue to shape the landscape, ensuring consumer protection and financial stability. In this region, the competitive landscape is dominated by major players like JPMorgan Chase, Bank of America, and Wells Fargo. These institutions are investing heavily in fintech partnerships and digital transformation to enhance customer experience. The presence of innovative startups is also notable, contributing to a dynamic ecosystem that fosters competition and drives service improvements. Overall, North America remains a leader in retail banking innovation and customer-centric solutions.

Europe : Evolving Banking Landscape

The European retail banking market is undergoing significant transformation, driven by regulatory changes and the rise of digital banking. Germany and the UK are the largest markets, holding approximately 25% and 20% market shares, respectively. The demand for personalized banking services and digital solutions is increasing, supported by regulations like PSD2, which promotes open banking and enhances competition. This regulatory environment is fostering innovation and improving customer access to financial services. Leading countries in this region include Germany, the UK, and France, with key players such as Deutsche Bank, HSBC, and BNP Paribas. The competitive landscape is marked by a mix of traditional banks and fintech companies, which are reshaping customer interactions through technology. The presence of neobanks is also growing, appealing to younger consumers seeking seamless digital experiences. Overall, Europe is positioning itself as a hub for banking innovation and customer engagement.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific retail banking market is witnessing rapid growth, driven by increasing urbanization and a rising middle class. China and India are the largest markets, accounting for approximately 40% and 15% of the market share, respectively. The demand for banking services is expanding, fueled by technological advancements and a shift towards digital banking. Regulatory support for fintech innovations is also a key driver, enhancing financial inclusion and customer access to services. In this region, key players include ICBC, China Construction Bank, and HDFC Bank, which are leveraging technology to improve customer experiences. The competitive landscape is characterized by a mix of traditional banks and emerging fintech companies, creating a dynamic environment. The presence of mobile banking solutions is particularly strong, catering to the tech-savvy population. Overall, Asia-Pacific is poised for continued growth, with significant opportunities for investment and innovation in retail banking.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa retail banking market is characterized by untapped opportunities and a growing demand for banking services. South Africa and the UAE are the largest markets, holding approximately 25% and 20% market shares, respectively. The region is experiencing a shift towards digital banking, driven by increasing smartphone penetration and a young population eager for financial services. Regulatory initiatives aimed at enhancing financial inclusion are also playing a crucial role in market growth. Leading countries in this region include South Africa, the UAE, and Nigeria, with key players such as Standard Bank, First National Bank, and Emirates NBD. The competitive landscape is evolving, with traditional banks facing competition from fintech startups that offer innovative solutions. The presence of mobile banking and digital wallets is expanding, catering to the needs of a diverse customer base. Overall, the Middle East and Africa present significant growth potential for retail banking, driven by technological advancements and changing consumer preferences.