Rising Popularity of Probiotics

The Brazil prebiotics market is witnessing a parallel rise in the popularity of probiotics, which has indirectly fueled the demand for prebiotic ingredients. As consumers become more educated about gut health, they are increasingly recognizing the synergistic relationship between prebiotics and probiotics. This awareness has led to a growing preference for products that combine both types of ingredients, thereby enhancing their effectiveness. Market data indicates that the probiotic segment in Brazil is expected to grow at a CAGR of around 10% in the coming years, which suggests a corresponding increase in the demand for prebiotics as complementary ingredients. Manufacturers are likely to capitalize on this trend by developing innovative products that highlight the benefits of both prebiotics and probiotics, thus driving growth in the Brazil prebiotics market.

Government Initiatives and Regulations

The Brazil prebiotics market is significantly influenced by government initiatives aimed at promoting health and nutrition. The Brazilian government has implemented various policies to encourage the consumption of functional ingredients, including prebiotics, as part of a broader strategy to combat malnutrition and promote public health. For instance, the National Health Surveillance Agency (ANVISA) has established guidelines for the labeling and marketing of functional foods, ensuring that consumers are well-informed about the health benefits of prebiotics. Additionally, government-sponsored campaigns to raise awareness about gut health and its connection to overall wellness are likely to enhance consumer interest in prebiotic products. These initiatives not only support the growth of the Brazil prebiotics market but also create a favorable regulatory environment for manufacturers to innovate and expand their product offerings.

Increasing Demand for Functional Foods

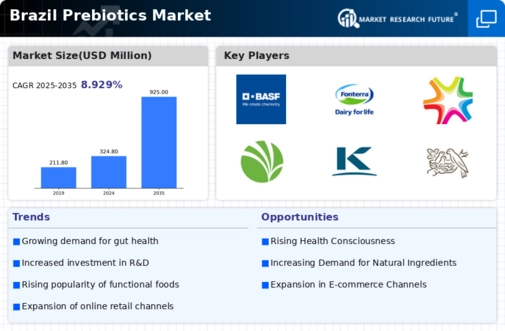

The Brazil prebiotics market is experiencing a notable surge in demand for functional foods, driven by consumers' growing awareness of health and wellness. As individuals increasingly seek products that offer health benefits beyond basic nutrition, prebiotics have gained traction for their role in enhancing gut health and overall well-being. According to recent data, the functional food sector in Brazil is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend indicates a robust market potential for prebiotic ingredients, as manufacturers are likely to incorporate them into various food products to cater to health-conscious consumers. The increasing prevalence of lifestyle-related diseases further propels this demand, as consumers actively seek preventive measures through dietary choices, thereby bolstering the Brazil prebiotics market.

Expansion of the Food and Beverage Sector

The Brazil prebiotics market is benefiting from the expansion of the food and beverage sector, which is increasingly incorporating prebiotic ingredients into their offerings. As consumer preferences shift towards healthier options, food and beverage manufacturers are actively seeking to enhance their products with functional ingredients like prebiotics. The Brazilian food and beverage market is projected to reach a value of over USD 200 billion by 2026, indicating a substantial opportunity for prebiotic integration. This growth is further supported by the rising trend of clean label products, where consumers demand transparency regarding ingredient sourcing and health benefits. Consequently, the incorporation of prebiotics into various food and beverage products not only meets consumer demand but also positions manufacturers favorably within the competitive landscape of the Brazil prebiotics market.

Growing Interest in Personalized Nutrition

The Brazil prebiotics market is increasingly influenced by the growing interest in personalized nutrition, which emphasizes tailored dietary solutions based on individual health needs. As consumers become more aware of the unique benefits of prebiotics, there is a rising demand for products that cater to specific health concerns, such as digestive health and immune support. This trend is reflected in the increasing number of companies offering customized prebiotic formulations designed to meet individual dietary preferences and health goals. Market Research Future suggests that the personalized nutrition segment is expected to grow significantly in Brazil, potentially reaching a market size of USD 1 billion by 2028. This shift towards personalized dietary solutions presents a unique opportunity for the Brazil prebiotics market to innovate and develop targeted products that resonate with health-conscious consumers.