Rising Demand for Process Heat

The industrial boilers market in Brazil experiences a notable increase in demand for process heat across various sectors, including food processing, chemicals, and textiles. This demand is driven by the need for efficient heating solutions that can enhance productivity and reduce operational costs. In 2025, the market is projected to grow at a CAGR of approximately 5.2%, reflecting the ongoing industrial expansion in Brazil. As industries seek to optimize their processes, the reliance on industrial boilers for consistent and reliable heat generation becomes paramount. This trend indicates a robust growth trajectory for the industrial boilers market, as manufacturers adapt to meet the evolving needs of diverse industries.

Regulatory Compliance and Standards

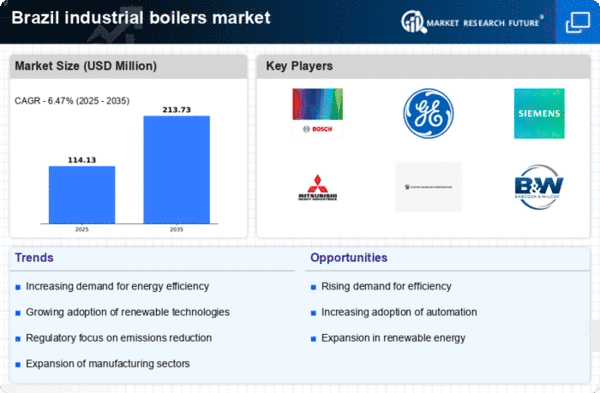

The industrial boilers market in Brazil is significantly influenced by stringent regulatory frameworks aimed at ensuring safety and environmental compliance. The Brazilian government has implemented various standards that mandate the use of efficient and low-emission boilers. Compliance with these regulations not only enhances operational safety but also promotes sustainability within industries. As a result, manufacturers are increasingly investing in advanced boiler technologies that meet these standards. The market is expected to witness a shift towards more compliant and efficient boiler systems, which could potentially lead to a market growth of around 4.8% in the coming years. This regulatory landscape plays a crucial role in shaping the industrial boilers market.

Investment in Renewable Energy Sources

The industrial boilers market in Brazil is poised for transformation due to the growing investment in renewable energy sources. As industries seek to reduce their carbon footprint, there is a marked shift towards biomass and other renewable fuels for boiler operations. This transition is supported by government incentives and initiatives aimed at promoting sustainable energy practices. In 2025, it is anticipated that the share of renewable energy in the industrial boilers market could reach approximately 30%, reflecting a significant change in fuel sourcing strategies. This trend not only aligns with The industrial boilers market for substantial growth as companies adapt to greener technologies.

Economic Growth and Industrial Expansion

The industrial boilers market in Brazil is closely linked to the country's economic growth and industrial expansion. As Brazil continues to develop its manufacturing capabilities, there is an increasing need for reliable and efficient heating solutions. The growth of sectors such as automotive, pharmaceuticals, and food production is driving the demand for industrial boilers. In 2025, the market is expected to benefit from a projected GDP growth of approximately 3.5%, which will likely stimulate investments in industrial infrastructure. This economic backdrop suggests a favorable environment for the industrial boilers market, as industries seek to enhance their operational efficiency and capacity.

Technological Advancements in Boiler Design

The industrial boilers market in Brazil is witnessing rapid technological advancements that enhance efficiency and performance. Innovations in boiler design, such as modular systems and advanced control technologies, are enabling industries to achieve higher thermal efficiency and lower emissions. These advancements are crucial as they allow for better integration with existing systems and facilitate easier maintenance. The market is likely to see an increase in the adoption of these advanced boiler designs, which could lead to a projected growth rate of around 5.5% over the next few years. This focus on innovation is essential for the industrial boilers market to remain competitive and meet the evolving demands of various sectors.