Increased Industrial Production

Japan's industrial sector is currently on an upward trajectory, which is positively impacting the industrial boilers market. The resurgence in manufacturing activities, particularly in sectors such as automotive and electronics, has led to a heightened demand for steam and hot water generation. According to recent data, the manufacturing output in Japan has increased by approximately 5% in the last year, driving the need for efficient industrial boilers. This growth in production not only necessitates reliable heating solutions but also encourages investments in advanced boiler technologies that can support increased operational capacities while maintaining compliance with environmental standards.

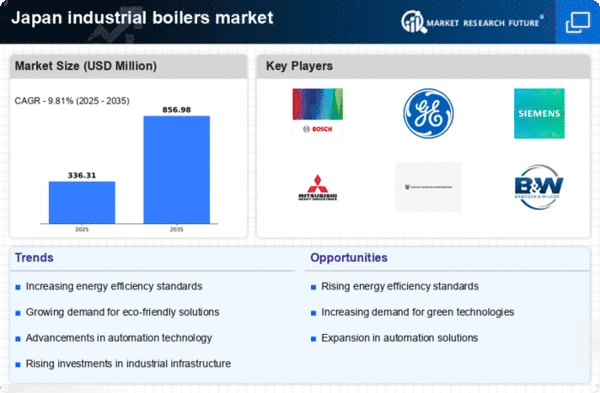

Rising Energy Efficiency Standards

The industrial boilers market in Japan is experiencing a notable shift due to the implementation of stringent energy efficiency standards. These regulations compel manufacturers to innovate and enhance the efficiency of their boiler systems. As a result, the market is witnessing a surge in demand for high-efficiency boilers that can operate at lower energy consumption levels. The Japanese government has set ambitious targets to reduce energy consumption by 30% by 2030, which directly influences the industrial boilers market. Companies that adapt to these standards are likely to gain a competitive edge, as they can offer products that align with both regulatory requirements and customer expectations for sustainability.

Focus on Environmental Sustainability

The industrial boilers market in Japan is increasingly influenced by a growing emphasis on environmental sustainability. Companies are under pressure to reduce their carbon footprints and adopt cleaner technologies. This trend is evident as many industries are transitioning towards low-emission boilers and exploring alternative fuels. The Japanese government has set a target to achieve net-zero greenhouse gas emissions by 2050, which is likely to propel the adoption of eco-friendly boiler solutions. As industries strive to meet these sustainability goals, the demand for innovative and environmentally compliant boilers is expected to rise, thereby shaping the future landscape of the industrial boilers market.

Investment in Infrastructure Development

Japan's ongoing investment in infrastructure development is creating a favorable environment for the industrial boilers market. The government has allocated substantial funds for upgrading and expanding industrial facilities, particularly in energy-intensive sectors. This investment is expected to drive the demand for new boiler installations and replacements of outdated systems. With a focus on enhancing energy efficiency and reducing emissions, the industrial boilers market is likely to benefit from these infrastructure projects. As industries modernize their facilities, the need for advanced boiler technologies that meet contemporary standards will become increasingly critical.

Technological Integration and Automation

The integration of advanced technologies and automation in industrial processes is significantly shaping the industrial boilers market in Japan. This trend is leading to enhanced efficiency and reduced operational costs. The adoption of IoT and AI technologies allows for real-time monitoring and optimization of boiler operations, leading to enhanced efficiency and reduced operational costs. As industries increasingly embrace digital transformation, the demand for smart boilers that can seamlessly integrate with existing systems is likely to grow. This trend not only improves operational reliability but also aligns with the broader industry movement towards Industry 4.0, which emphasizes automation and data exchange in manufacturing environments.