Enhanced Audience Engagement

Enhanced audience engagement is a pivotal factor driving the generative ai-in-media-and-entertainment market in Brazil. With the proliferation of digital platforms, content creators are increasingly leveraging AI to analyze viewer preferences and tailor experiences accordingly. This data-driven approach enables the production of personalized content that resonates with specific demographics. For instance, AI algorithms can predict trends and suggest content that aligns with audience interests, thereby increasing viewer retention rates. In 2025, it is estimated that personalized content could boost engagement metrics by as much as 40%. Consequently, the generative ai-in-media-and-entertainment market is likely to evolve towards more interactive and immersive experiences, fostering deeper connections between creators and audiences.

Cost Efficiency in Production

Cost efficiency is emerging as a critical driver in the generative ai-in-media-and-entertainment market. Brazilian media companies are increasingly adopting AI technologies to streamline production processes and reduce operational costs. By automating various aspects of content creation, such as scriptwriting and video editing, companies can significantly lower their expenses. Reports indicate that AI implementation can reduce production costs by up to 30%, allowing for reallocation of resources towards more creative endeavors. This financial advantage is particularly appealing in a competitive landscape where profit margins are often tight. As a result, the generative ai-in-media-and-entertainment market is likely to witness a shift towards more AI-integrated workflows, enhancing overall productivity and profitability.

Collaboration with Technology Firms

Collaboration with technology firms is becoming a significant driver in the generative ai-in-media-and-entertainment market. Brazilian media companies are increasingly partnering with tech startups and established firms to harness cutting-edge AI solutions. These collaborations facilitate access to advanced tools and expertise, enabling media producers to innovate and enhance their offerings. For example, partnerships with AI developers can lead to the creation of sophisticated algorithms that improve content recommendation systems or automate editing processes. This trend is indicative of a broader shift towards interdisciplinary cooperation, which is likely to yield new creative possibilities. As such, the generative ai-in-media-and-entertainment market is poised for transformative growth through these strategic alliances.

Rising Demand for Innovative Content

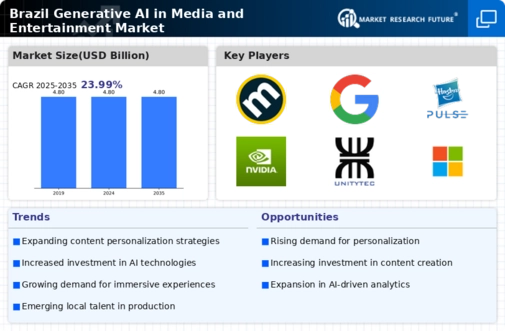

The generative ai-in-media-and-entertainment market in Brazil is experiencing a notable surge in demand for innovative content. As audiences become increasingly discerning, there is a pressing need for unique and engaging media experiences. This trend is reflected in the growing investment in AI technologies, which are capable of producing high-quality content at scale. In 2025, the Brazilian media sector is projected to allocate approximately $1.5 billion towards AI-driven content creation. This investment is likely to enhance the creative capabilities of producers, enabling them to meet the evolving preferences of consumers. Furthermore, the integration of generative AI tools allows for the rapid development of diverse formats, from films to interactive media, thereby expanding the market's potential reach and appeal.

Regulatory Support for AI Integration

Regulatory support for AI integration is emerging as a crucial driver in the generative ai-in-media-and-entertainment market. The Brazilian government is actively promoting the adoption of AI technologies across various sectors, including media and entertainment. Initiatives aimed at fostering innovation and providing funding for AI research are likely to create a conducive environment for growth. In 2025, it is anticipated that government incentives could lead to a 25% increase in AI adoption among media companies. This regulatory backing not only encourages investment but also helps establish ethical guidelines for AI usage, ensuring that the generative ai-in-media-and-entertainment market develops responsibly. As a result, companies may feel more confident in integrating AI into their operations, further driving market expansion.