Rising Demand for IoT Solutions

The proliferation of Internet of Things (IoT) devices in Brazil is significantly influencing the Brazil Ethernet Switch Market. As industries adopt IoT technologies for automation and data collection, the need for reliable networking solutions becomes paramount. Ethernet switches are integral to connecting various IoT devices, ensuring stable and efficient communication. The Brazilian IoT market is projected to grow substantially, with estimates suggesting a market size of over USD 10 billion by 2027. This growth is likely to spur demand for advanced Ethernet switches that can handle the increased data flow and provide the necessary bandwidth for IoT applications.

Growing Adoption of Cloud Services

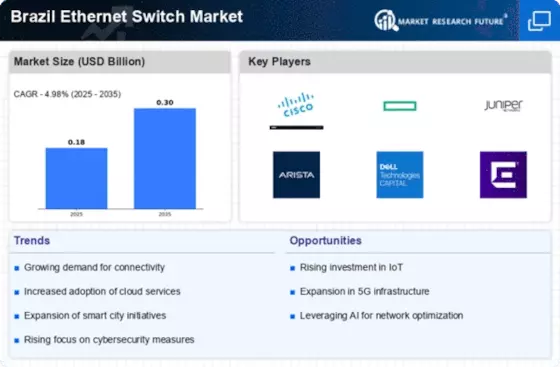

The Brazil Ethernet Switch Market is experiencing a notable increase in the adoption of cloud services across various sectors. As businesses transition to cloud-based solutions, the demand for robust networking infrastructure intensifies. Ethernet switches play a crucial role in facilitating seamless connectivity and data transfer between cloud services and on-premises systems. According to recent data, the cloud computing market in Brazil is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive the need for advanced Ethernet switches that can support higher bandwidth and lower latency, thereby enhancing overall network performance.

Increased Internet Penetration Rates

The Brazil Ethernet Switch Market is benefiting from the rising internet penetration rates across the country. With more individuals and businesses gaining access to the internet, the demand for networking equipment, including Ethernet switches, is on the rise. Recent statistics indicate that Brazil's internet penetration rate has surpassed 75%, with millions of new users coming online each year. This surge in connectivity necessitates the deployment of efficient networking solutions to manage increased data traffic. Consequently, Ethernet switches are becoming indispensable for both residential and commercial networks, driving growth in the market as service providers seek to enhance their infrastructure.

Expansion of Smart Cities Initiatives

Brazil is actively pursuing smart city initiatives, which significantly impacts the Brazil Ethernet Switch Market. These initiatives aim to integrate technology into urban infrastructure, enhancing efficiency and sustainability. Ethernet switches are essential components in the deployment of smart city applications, such as traffic management systems, public safety networks, and smart grid technologies. The Brazilian government has allocated substantial funding for these projects, indicating a commitment to modernizing urban environments. As smart cities evolve, the demand for reliable and high-capacity Ethernet switches is expected to rise, creating opportunities for market players to innovate and expand their offerings.

Focus on Network Security Enhancements

In the context of the Brazil Ethernet Switch Market, there is a growing emphasis on network security enhancements. As cyber threats become more sophisticated, organizations are prioritizing the implementation of secure networking solutions. Ethernet switches equipped with advanced security features, such as access control and traffic monitoring, are increasingly sought after. The Brazilian government has also introduced regulations aimed at improving cybersecurity across various sectors, further driving the demand for secure networking equipment. This focus on security is likely to shape the market landscape, as businesses invest in Ethernet switches that not only provide connectivity but also safeguard their networks against potential threats.