Consumer Awareness and Education

Consumer awareness and education play a pivotal role in the electric vehicles-battery market in Brazil. As more information becomes available regarding the benefits of electric vehicles, consumers are increasingly inclined to consider them as viable alternatives to traditional vehicles. In 2025, surveys indicate that approximately 40% of Brazilian consumers are aware of the advantages of electric mobility, which is likely to influence their purchasing decisions. The electric vehicles-battery market industry can capitalize on this trend by providing educational resources and promoting the advantages of electric vehicles, such as lower operating costs and reduced environmental impact. Enhanced consumer understanding can lead to increased adoption rates, thereby driving market growth. As awareness continues to rise, the electric vehicles-battery market is expected to flourish, supported by informed consumer choices.

Government Regulations on Emissions

Government regulations on emissions are shaping the landscape of the electric vehicles-battery market in Brazil. Stricter emissions standards are being implemented to combat air pollution and promote cleaner transportation options. By 2025, it is anticipated that new regulations will require a significant reduction in emissions from vehicles, pushing consumers and manufacturers towards electric alternatives. This regulatory environment is likely to accelerate the transition to electric vehicles, thereby increasing the demand for batteries. The electric vehicles-battery market industry is expected to adapt to these changes, with manufacturers focusing on developing more efficient and environmentally friendly battery technologies. As compliance with these regulations becomes essential, the market is poised for growth driven by both necessity and innovation.

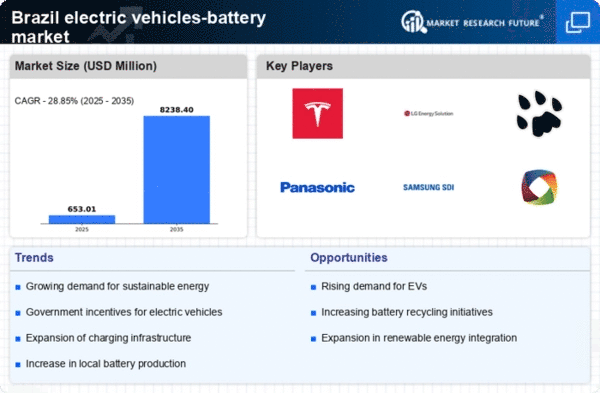

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles is a primary driver for the electric vehicles-battery market in Brazil. As consumers become more environmentally conscious, the shift towards electric mobility is evident. In 2025, electric vehicle sales in Brazil are projected to grow by approximately 30%, indicating a robust market potential. This surge in demand necessitates a corresponding increase in battery production and innovation. The electric vehicles-battery market industry is thus positioned to benefit from this trend, as manufacturers strive to meet consumer expectations for performance and sustainability. Additionally, the Brazilian government has been promoting electric vehicle adoption through various initiatives, further stimulating market growth. As a result, the electric vehicles-battery market is likely to experience significant expansion, driven by both consumer preferences and supportive policies.

Investment in Charging Infrastructure

Investment in charging infrastructure is crucial for the growth of the electric vehicles-battery market in Brazil. The availability of charging stations directly influences consumer adoption of electric vehicles. In 2025, Brazil aims to increase its charging infrastructure by 50%, which could significantly enhance the convenience of owning an electric vehicle. This expansion is expected to alleviate range anxiety among potential buyers, thereby boosting sales. The electric vehicles-battery market industry stands to gain from this development, as a robust charging network will encourage more consumers to transition from traditional vehicles to electric ones. Furthermore, partnerships between private companies and government entities are likely to facilitate this infrastructure growth, creating a more favorable environment for electric vehicle adoption and battery utilization.

Advancements in Battery Recycling Technologies

Advancements in battery recycling technologies are emerging as a vital driver for the electric vehicles-battery market in Brazil. As the market expands, the need for sustainable battery disposal and recycling becomes increasingly important. In 2025, it is estimated that around 20% of batteries will be recycled, which could significantly reduce environmental impact. The electric vehicles-battery market industry is likely to benefit from innovations in recycling processes, which can recover valuable materials and reduce the demand for new raw materials. This not only supports sustainability goals but also enhances the overall efficiency of the battery supply chain. As Brazilian consumers become more aware of environmental issues, the emphasis on recycling will likely influence their purchasing decisions, further driving the market.