Regulatory Compliance Pressures

Brazil's regulatory landscape is evolving, with stringent data protection laws such as the General Data Protection Law (LGPD) coming into effect. These regulations impose strict requirements on organizations regarding the handling and storage of personal data. Consequently, businesses are compelled to adopt digital vault solutions to ensure compliance and avoid hefty fines. The digital vault market is expected to benefit from this regulatory pressure, as companies seek to implement secure data storage practices. In 2025, it is projected that compliance-related investments will account for over 30% of the total IT budget for many organizations in Brazil, further driving the demand for digital vault technologies.

Rising Awareness of Data Privacy

There is a growing awareness among Brazilian consumers regarding data privacy and the importance of protecting personal information. This heightened consciousness is influencing businesses to adopt digital vault solutions to safeguard customer data. As consumers demand greater transparency and control over their data, organizations are compelled to implement secure storage practices. The digital vault market is likely to thrive as companies respond to these consumer expectations. In 2025, it is anticipated that organizations prioritizing data privacy will see a 25% increase in customer trust and loyalty, further incentivizing the adoption of digital vault technologies.

Shift Towards Digital Transformation

The ongoing digital transformation across various sectors in Brazil is significantly influencing the digital vault market. As organizations transition to digital operations, the need for secure data storage solutions becomes paramount. This shift is evident in the increasing adoption of cloud-based services, which are projected to grow at a CAGR of 20% through 2025. The digital vault market stands to gain from this trend, as businesses seek to protect their digital assets amidst the rapid technological advancements. The integration of digital vault solutions into existing IT infrastructures is likely to enhance operational efficiency and data security, thereby fostering market growth.

Growing Demand for Data Security Solutions

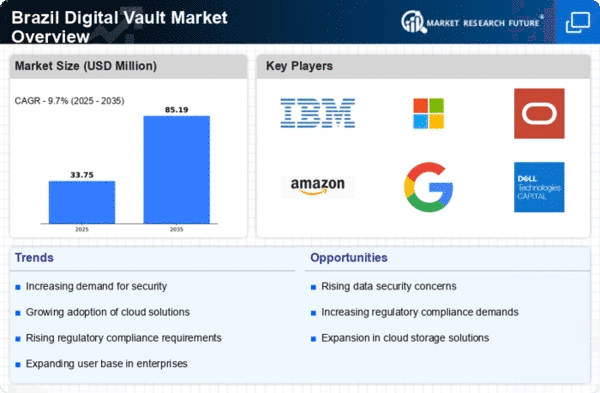

The increasing frequency of cyber threats and data breaches in Brazil has led to a heightened demand for robust data security solutions. Organizations are increasingly recognizing the necessity of safeguarding sensitive information, which propels the growth of the digital vault market. In 2025, it is estimated that the cybersecurity market in Brazil will reach approximately $10 billion, indicating a strong focus on protective measures. This trend suggests that businesses are prioritizing investments in digital vault technologies to ensure compliance with data protection regulations and to maintain customer trust. As a result, the digital vault market is likely to experience significant growth driven by the urgent need for enhanced security measures.

Technological Advancements in Data Storage

Technological innovations in data storage and encryption are playing a crucial role in shaping the digital vault market. Advances in artificial intelligence and machine learning are enabling more sophisticated security measures, which are essential for protecting sensitive information. In Brazil, the market for advanced data storage solutions is projected to grow by 15% annually, driven by the need for enhanced security features. These technological advancements not only improve the efficiency of digital vault solutions but also make them more accessible to a wider range of businesses. As organizations seek to leverage these innovations, the digital vault market is expected to expand significantly.