Growing Cybersecurity Threats

The rise in cybersecurity threats is a significant driver for the digital vault market. With cyberattacks becoming more sophisticated, organizations are compelled to invest in advanced security solutions to protect their data. The digital vault market is positioned as a critical component in the cybersecurity landscape, offering secure storage and access controls. In 2025, it is estimated that cybercrime will cost businesses over $10 trillion annually, highlighting the urgency for effective data protection strategies. As organizations seek to fortify their defenses against potential breaches, the digital vault market is likely to see increased adoption, reflecting a proactive approach to cybersecurity.

Increasing Regulatory Compliance

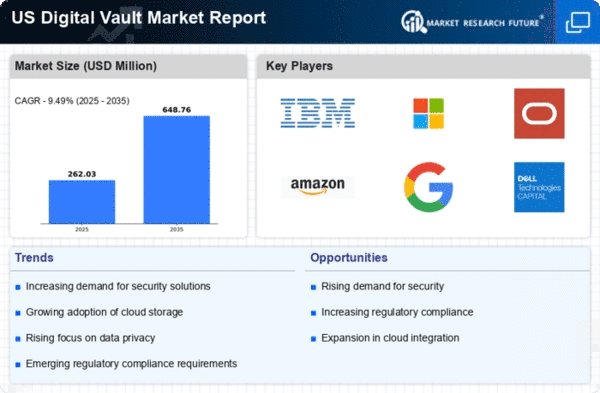

The digital vault market is experiencing a surge in demand driven by the need for organizations to comply with stringent regulatory frameworks. In the US, regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR) necessitate robust data protection measures. Companies are increasingly adopting digital vault solutions to ensure compliance, thereby mitigating the risk of hefty fines and reputational damage. The market is projected to grow as businesses prioritize compliance, with an estimated growth rate of 15% annually. This trend indicates that the digital vault market is becoming essential for organizations aiming to safeguard sensitive information while adhering to legal requirements.

Rising Adoption of Cloud Solutions

The digital vault market is benefiting from the rising adoption of cloud-based solutions. As organizations migrate to the cloud for enhanced flexibility and scalability, the demand for secure data storage options is increasing. Cloud-based digital vaults offer organizations the ability to store and manage sensitive information securely while ensuring accessibility from various locations. In 2025, the cloud storage market is anticipated to reach $137 billion, indicating a robust growth trajectory. This trend suggests that the digital vault market will continue to expand as businesses seek reliable and secure cloud solutions to protect their data.

Shift Towards Digital Transformation

The ongoing shift towards digital transformation across various sectors is propelling the digital vault market forward. Organizations are increasingly digitizing their operations, leading to a heightened need for secure data storage solutions. This transformation is particularly evident in industries such as finance and healthcare, where sensitive information must be protected. The digital vault market is expected to grow as businesses recognize the importance of integrating secure data management practices into their digital strategies. By 2026, the digital transformation market is projected to reach $3 trillion, suggesting that the digital vault market will play a pivotal role in supporting this transition.

Enhanced User Awareness and Education

There is a growing awareness among users regarding the importance of data security, which is driving the digital vault market. As individuals and organizations become more educated about the risks associated with data breaches, they are increasingly seeking solutions that offer robust protection. This heightened awareness is leading to a greater demand for digital vault solutions that provide secure storage and management of sensitive information. In 2025, it is estimated that the market for data protection solutions will exceed $100 billion, reflecting the increasing prioritization of data security. This trend indicates that the digital vault market is likely to thrive as users become more proactive in safeguarding their data.