Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the cloud storage market in Brazil. Organizations are increasingly recognizing the financial benefits of transitioning to cloud-based storage solutions. By leveraging cloud storage, companies can significantly reduce their capital expenditures associated with maintaining on-premises infrastructure. Recent analyses indicate that businesses can save up to 30% on storage costs by adopting cloud solutions. This shift not only alleviates the burden of hardware maintenance but also allows for more predictable budgeting through subscription-based models. As Brazilian companies strive to optimize their operational costs, the cloud storage market is likely to witness a sustained influx of users seeking affordable and efficient storage alternatives. This trend underscores the importance of cost management in driving the adoption of cloud storage solutions across various sectors.

Rising Demand for Scalable Solutions

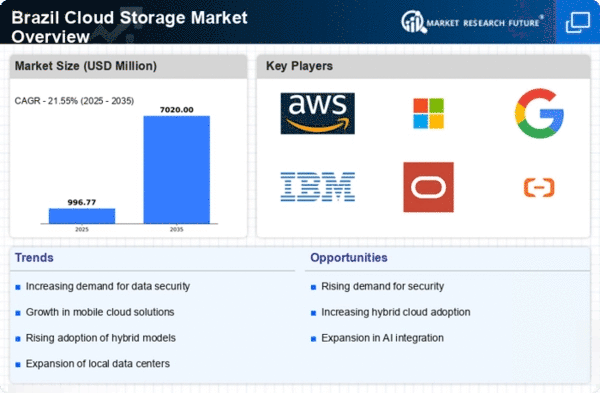

The cloud storage market in Brazil experiences a notable surge in demand for scalable solutions. As businesses expand, they require storage options that can grow alongside their operations. This trend is particularly evident among enterprises seeking to manage increasing volumes of data efficiently. According to recent data, the Brazilian cloud storage market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for flexible storage solutions that can accommodate fluctuating data requirements. Companies are increasingly opting for cloud storage services that offer scalability, allowing them to adjust their storage capacity based on real-time needs. This adaptability is crucial in a rapidly evolving digital landscape, where data generation is on the rise. Consequently, the cloud storage market is likely to see continued investment as organizations prioritize scalable solutions to meet their operational demands.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are critical factors influencing the cloud storage market in Brazil. As data protection regulations become more stringent, organizations are compelled to ensure that their data storage practices align with local laws. The Brazilian General Data Protection Law (LGPD) mandates that companies handle personal data responsibly, which has led to an increased focus on compliant cloud storage solutions. Businesses are seeking providers that can guarantee data sovereignty, ensuring that their data remains within Brazilian borders. This trend is likely to drive the demand for local cloud storage services that adhere to regulatory requirements. As organizations prioritize compliance, the cloud storage market is expected to witness growth, with an emphasis on solutions that offer robust security and data protection features. This focus on regulatory adherence is essential for building trust and ensuring the long-term viability of cloud storage services in Brazil.

Growing Data Generation and Management Needs

The cloud storage market in Brazil is significantly influenced by the exponential growth in data generation. With the increasing digitization of business processes, organizations are producing vast amounts of data that require effective management and storage solutions. Recent statistics suggest that data generation in Brazil is expected to reach 2.5 quintillion bytes daily by 2025. This surge necessitates robust cloud storage solutions capable of handling large datasets efficiently. As companies seek to harness the power of big data analytics, the demand for reliable and scalable cloud storage options is likely to rise. This trend highlights the critical role of cloud storage in enabling businesses to manage their data effectively, ensuring accessibility and security. Consequently, the cloud storage market is poised for growth as organizations prioritize data management strategies that leverage cloud technologies.

Enhanced Collaboration and Remote Work Solutions

The cloud storage market in Brazil is increasingly driven by the need for enhanced collaboration and remote work solutions. As organizations adapt to flexible work arrangements, the demand for cloud-based storage that facilitates seamless collaboration among teams has surged. Cloud storage solutions enable employees to access, share, and collaborate on documents in real-time, regardless of their physical location. This capability is particularly vital for businesses aiming to maintain productivity in a remote work environment. Recent surveys indicate that approximately 70% of Brazilian companies are investing in cloud technologies to support remote work initiatives. This trend underscores the importance of cloud storage in fostering collaboration and ensuring that teams can work efficiently, regardless of their geographical distribution. As remote work becomes a permanent fixture in many organizations, the cloud storage market is likely to expand to meet these evolving needs.