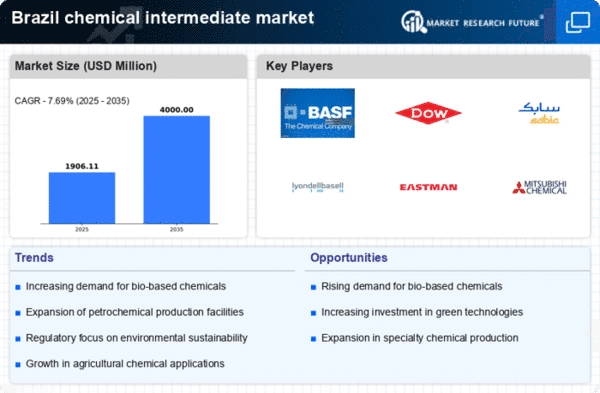

The chemical intermediate market in Brazil is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, construction, and consumer goods. Key players like BASF SE (Germany), Dow Inc. (US), and SABIC (Saudi Arabia) are strategically positioned to leverage their extensive product portfolios and technological capabilities. BASF SE (Germany) focuses on innovation and sustainability, aiming to enhance its product offerings while reducing environmental impact. Dow Inc. (US) emphasizes digital transformation and operational efficiency, which allows for better responsiveness to market demands. Meanwhile, SABIC (Saudi Arabia) is actively pursuing regional expansion and partnerships to strengthen its market presence, indicating a collective strategy among these companies to enhance competitiveness through innovation and collaboration.The market structure appears moderately fragmented, with several players vying for market share. Key business tactics include localizing manufacturing to reduce costs and optimize supply chains, which is crucial in a region where logistics can be challenging. The influence of major companies is significant, as their operational strategies often set benchmarks for smaller firms, thereby shaping the overall competitive dynamics.

In October BASF SE (Germany) announced a new investment in a state-of-the-art production facility in São Paulo, aimed at increasing its capacity for specialty chemicals. This strategic move is likely to enhance BASF's ability to meet local demand while reinforcing its commitment to sustainability through advanced manufacturing technologies. Such investments not only bolster production capabilities but also signal a long-term commitment to the Brazilian market.

In September Dow Inc. (US) launched a digital platform designed to streamline its supply chain operations in Brazil. This initiative is expected to improve efficiency and reduce lead times, thereby enhancing customer satisfaction. The integration of digital tools into traditional manufacturing processes reflects a broader trend towards digitalization in the chemical sector, positioning Dow as a leader in operational excellence.

In August SABIC (Saudi Arabia) entered into a strategic partnership with a local Brazilian firm to co-develop sustainable chemical solutions. This collaboration is indicative of a growing trend towards sustainability in the chemical intermediate market, as companies seek to align their operations with environmental goals. Such partnerships not only enhance product offerings but also foster innovation through shared expertise.

As of November the competitive landscape is increasingly defined by trends such as digitalization, sustainability, and the integration of artificial intelligence in operations. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to tackle complex challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancement, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the chemical intermediate market.