Rise of Insurtech Startups

The emergence of insurtech startups in Brazil is reshaping the landscape of the blockchain insurance market. These innovative companies leverage blockchain technology to create disruptive business models that challenge traditional insurance practices. By offering tailored products and services, insurtechs are attracting a younger demographic that values convenience and digital solutions. In 2025, it is projected that insurtechs will capture approximately 25% of the Brazilian insurance market, driving further interest in blockchain applications. This influx of new players is likely to foster collaboration between established insurers and startups, leading to the development of more efficient and customer-centric insurance solutions.

Increased Consumer Awareness

Consumer awareness regarding the benefits of blockchain technology is on the rise in Brazil, significantly impacting the blockchain insurance market. As individuals become more informed about the advantages of decentralized systems, such as enhanced security and reduced fraud, they are more inclined to seek insurance products that utilize blockchain. Surveys indicate that around 55% of Brazilian consumers are willing to consider blockchain-based insurance solutions. This growing awareness is likely to drive demand for innovative insurance products, prompting insurers to adopt blockchain technology to meet consumer expectations and differentiate themselves in a competitive market.

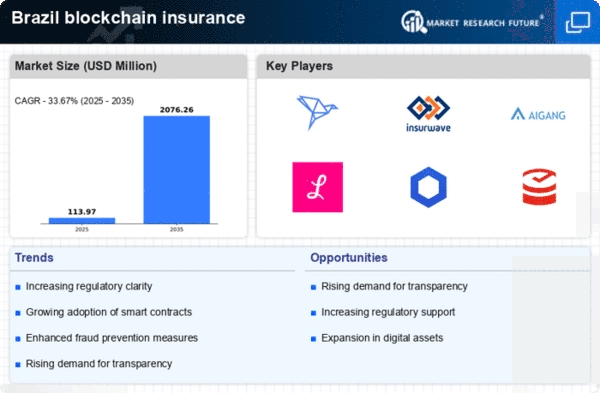

Growing Demand for Transparency

The blockchain insurance market in Brazil is experiencing a notable surge in demand for transparency among consumers and businesses alike. This demand is driven by the inherent characteristics of blockchain technology, which offers immutable records and traceability. As consumers become more aware of their rights and the complexities of insurance products, they seek solutions that provide clear visibility into policy terms and claims processes. In 2025, it is estimated that approximately 60% of Brazilian consumers prioritize transparency when selecting insurance providers. This trend is likely to propel the adoption of blockchain solutions, as they can facilitate real-time access to information, thereby enhancing trust and accountability in the insurance sector.

Regulatory Support for Innovation

Regulatory frameworks in Brazil are evolving to support innovation within the blockchain insurance market. The Brazilian government has recognized the potential of blockchain technology to enhance efficiency and security in the insurance sector. Recent initiatives aim to create a conducive environment for blockchain adoption, including guidelines for data protection and smart contract usage. As regulatory clarity improves, insurers are more likely to invest in blockchain solutions, anticipating compliance with emerging standards. This supportive regulatory landscape is expected to encourage traditional insurers to explore blockchain applications, thereby accelerating the growth of the market.

Cost Efficiency through Automation

Cost efficiency remains a critical driver for the blockchain insurance market in Brazil. The implementation of blockchain technology can significantly reduce operational costs by automating various processes, such as claims handling and underwriting. By utilizing smart contracts, insurers can streamline operations, minimize human error, and expedite claims processing. Reports indicate that companies adopting blockchain solutions may reduce administrative costs by up to 30%. This potential for cost savings is particularly appealing to Brazilian insurers, who face competitive pressures to maintain profitability while improving service delivery. As a result, the blockchain insurance market is likely to witness increased investment in automation technologies.