Government Policies and Support

Government policies and support are pivotal in driving the Brazil biostimulants market. The Brazilian government has implemented various regulations and incentives aimed at promoting the use of biostimulants in agriculture. These policies not only facilitate the registration and commercialization of biostimulant products but also encourage research and development in this sector. For example, the Ministry of Agriculture has been actively involved in creating a regulatory framework that supports the safe use of biostimulants. This supportive environment is likely to attract investments and foster innovation, thereby enhancing the growth prospects of the biostimulants market in Brazil.

Growing Awareness and Education

The growing awareness and education regarding the benefits of biostimulants are significantly impacting the Brazil biostimulants market. Farmers are increasingly recognizing the advantages of using biostimulants, such as improved crop quality and reduced input costs. Educational programs and workshops conducted by agricultural organizations and universities are playing a vital role in disseminating knowledge about biostimulants. As more farmers become informed about the potential of these products, the adoption rates are expected to rise. This heightened awareness is likely to contribute to the expansion of the biostimulants market in Brazil, as farmers seek to enhance their agricultural practices.

Increasing Agricultural Productivity

The Brazil biostimulants market is experiencing a notable surge in demand due to the increasing need for agricultural productivity. With Brazil being one of the largest agricultural producers globally, the pressure to enhance crop yields while maintaining sustainability is paramount. Biostimulants, which improve plant growth and resilience, are becoming essential tools for farmers. According to recent data, the adoption of biostimulants has been linked to yield increases of up to 20% in certain crops. This trend is likely to continue as farmers seek innovative solutions to meet the growing food demand, thereby driving the Brazil biostimulants market forward.

Sustainability and Environmental Concerns

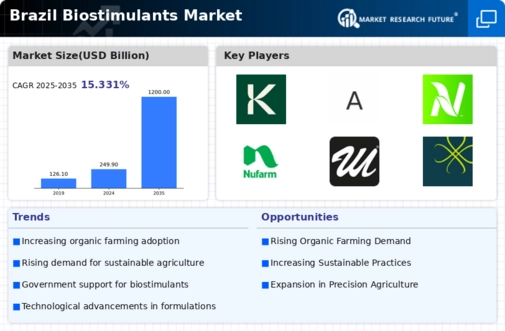

The Brazil biostimulants market is significantly influenced by the rising awareness of sustainability and environmental issues. As consumers increasingly demand eco-friendly agricultural practices, biostimulants offer a viable alternative to synthetic fertilizers and pesticides. These natural products not only enhance plant growth but also contribute to soil health and biodiversity. The Brazilian government has been promoting sustainable agriculture through various initiatives, which aligns with the growing trend of organic farming. This shift towards sustainable practices is expected to bolster the biostimulants market, as more farmers adopt these solutions to comply with environmental regulations and consumer preferences.

Technological Advancements in Agriculture

Technological advancements are playing a crucial role in shaping the Brazil biostimulants market. Innovations in formulation and application techniques are enhancing the effectiveness of biostimulants, making them more appealing to farmers. For instance, the development of nano-encapsulation technologies allows for targeted delivery of biostimulants, improving their efficacy. Additionally, precision agriculture tools are enabling farmers to apply biostimulants more efficiently, optimizing their use. As Brazil continues to embrace modern agricultural technologies, the integration of biostimulants into farming practices is likely to increase, further propelling the growth of the biostimulants market.