Government Support and Policies

The Brazilian government actively promotes the use of biofertilizers through various policies and incentives aimed at sustainable agriculture. The Ministry of Agriculture, Livestock and Food Supply has implemented programs that encourage farmers to adopt biofertilizers, which are seen as a means to enhance soil fertility while reducing chemical inputs. This support is crucial, as it aligns with Brazil's commitment to sustainable development and environmental protection. The Brazil biofertilizers market benefits from these initiatives, as they not only provide financial assistance but also facilitate research and development in biofertilizer technologies. As a result, the market is likely to experience growth driven by increased adoption of biofertilizers among farmers who seek to comply with government regulations and benefit from available subsidies.

Environmental Regulations and Compliance

The implementation of stringent environmental regulations in Brazil is driving the adoption of biofertilizers within the agricultural sector. These regulations aim to reduce the environmental impact of conventional fertilizers, which have been linked to soil degradation and water pollution. As a result, farmers are increasingly turning to biofertilizers as a compliant alternative that aligns with environmental standards. The Brazil biofertilizers market is likely to benefit from this regulatory landscape, as it encourages the transition towards more sustainable farming practices. Compliance with these regulations not only helps protect the environment but also enhances the marketability of agricultural products, thereby incentivizing farmers to adopt biofertilizers.

Rising Demand for Sustainable Agriculture

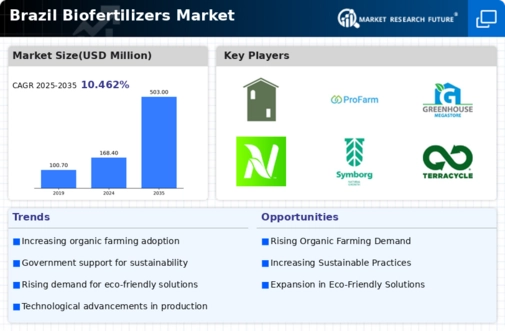

There is a notable shift in consumer preferences towards sustainable agricultural practices in Brazil, which is significantly influencing the biofertilizers market. As consumers become more environmentally conscious, they increasingly demand products that are produced using organic and sustainable methods. This trend is reflected in the growing market for organic produce, which has seen a compound annual growth rate of approximately 20% in recent years. Consequently, farmers are compelled to adopt biofertilizers to meet these consumer demands while also enhancing soil health and crop yields. The Brazil biofertilizers market is thus positioned to capitalize on this rising demand, as more agricultural producers seek to transition to sustainable practices that align with consumer expectations.

Increased Investment in Research and Development

Investment in research and development (R&D) within the biofertilizers sector is crucial for the growth of the Brazil biofertilizers market. Both public and private sectors are recognizing the importance of developing innovative biofertilizer solutions that can address the specific needs of Brazilian agriculture. This focus on R&D is expected to lead to the discovery of new biofertilizer formulations and application methods that enhance crop productivity and sustainability. As a result, the market is likely to see an influx of novel products that cater to diverse agricultural practices across Brazil. Increased R&D investment not only fosters innovation but also strengthens the competitive position of the Brazil biofertilizers market in the global arena.

Technological Innovations in Biofertilizer Production

Technological advancements in the production of biofertilizers are playing a pivotal role in shaping the Brazil biofertilizers market. Innovations such as microbial inoculants and advanced fermentation techniques have improved the efficacy and efficiency of biofertilizers, making them more appealing to farmers. The introduction of new strains of beneficial microorganisms has also enhanced the performance of biofertilizers, leading to increased crop yields and better soil health. As Brazilian farmers become more aware of these technological developments, the adoption of biofertilizers is expected to rise. This trend indicates a potential for market expansion, as improved products can attract a broader range of agricultural producers looking to enhance their farming practices.