Rising Awareness of Soil Health

The Japan biofertilizers market is witnessing a growing awareness of the importance of soil health among farmers and agricultural stakeholders. This awareness is largely driven by educational initiatives and research highlighting the detrimental effects of chemical fertilizers on soil quality. Biofertilizers, which enhance soil fertility and microbial activity, are increasingly recognized as a viable solution to restore and maintain soil health. Recent studies indicate that biofertilizers can improve soil structure and nutrient availability, leading to better crop performance. As farmers become more informed about the long-term benefits of biofertilizers, the demand for these products is expected to rise, further propelling the Japan biofertilizers market.

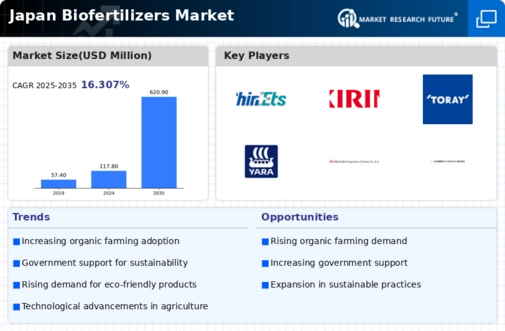

Increasing Demand for Sustainable Agriculture

The Japan biofertilizers market is experiencing a notable surge in demand for sustainable agricultural practices. As consumers become more environmentally conscious, there is a growing preference for organic produce, which in turn drives the need for biofertilizers. According to recent data, the organic farming sector in Japan has expanded significantly, with over 1.5 million hectares dedicated to organic cultivation. This shift towards sustainability is likely to propel the biofertilizers market, as farmers seek eco-friendly alternatives to chemical fertilizers. The increasing awareness of soil health and the benefits of biofertilizers in enhancing crop yield further supports this trend. Consequently, the Japan biofertilizers market is poised for growth as it aligns with the broader movement towards sustainable agriculture.

Government Regulations Favoring Biofertilizers

The Japan biofertilizers market is significantly influenced by government regulations that promote the use of bio-based products. The Japanese government has implemented various policies aimed at reducing chemical fertilizer usage and encouraging organic farming practices. For instance, the Ministry of Agriculture, Forestry and Fisheries has set ambitious targets for increasing the area under organic cultivation, which is expected to reach 3% of total agricultural land by 2025. Such regulatory frameworks not only incentivize farmers to adopt biofertilizers but also create a conducive environment for market growth. The government's commitment to sustainability and environmental protection is likely to enhance the adoption of biofertilizers, thereby driving the Japan biofertilizers market forward.

Growing Export Opportunities for Biofertilizers

The Japan biofertilizers market is poised to capitalize on growing export opportunities as global demand for organic and sustainable agricultural inputs rises. Countries across Asia and beyond are increasingly seeking biofertilizers to meet their own agricultural sustainability goals. Japan, with its advanced research and development capabilities in biofertilizer technology, is well-positioned to become a key exporter in this sector. Recent trade data suggests that Japan's biofertilizer exports have seen a steady increase, reflecting the international market's recognition of Japanese products' quality and efficacy. This trend not only supports the domestic biofertilizers market but also enhances Japan's reputation as a leader in sustainable agricultural practices.

Technological Advancements in Biofertilizer Production

The Japan biofertilizers market is benefiting from technological advancements that enhance the production and efficacy of biofertilizers. Innovations in microbial formulations and production processes are leading to more effective products that can cater to specific crop needs. For instance, the development of new strains of beneficial microorganisms has shown promise in improving nutrient uptake and disease resistance in plants. Additionally, advancements in fermentation technology are enabling the mass production of biofertilizers at lower costs. These technological improvements not only increase the competitiveness of biofertilizers against traditional fertilizers but also expand their application across various crops. As a result, the Japan biofertilizers market is likely to experience robust growth driven by these innovations.